Case: EARLY BIRD, INC.

The directors of Early Bird, Inc. were considering whether to begin a sales promotion for their line of specialty coffees earlier than originally planned. Over the last two quarters, they had worked out an extensive deal with the Fair-Trade Coffee Association for shadegrown, hand-picked beans. To promote this highquality coffee, they planned to discount their regular coffee beans as a loss leader, that is, as a way to bring more customers into their stores. The fair-trade label would show that they care about the coffee growers by paying a fair price, and care about the environment by supporting sustainable growing practices. "I think we should go ahead with an early promotion and price cuts," Tracy Brandon said. "After all, it couldn't hurt! At the very worst, we'll sell some coffee cheap for a little longer than we had planned, and on the other side we could beat New Morning to the punch." "That's really the question, isn't it?" replied Jack Santorini. "If New Morning really is planning their own promotion, and we start our promotion now, we would beat them to the punch. On the other hand, we might provoke a price war. And you know what a price war with that company means. We spend a lot of money fighting with each other. There's no real winner. We both just end up with less profit." Janice Wheeler, the finance VP for Early Bird, piped up, "The consumer wins in a price war.

They get to buy things cheaper for a while. We ought to be able to make something out of that." Ira Press, CEO for Early Bird, looked at the VP thoughtfully. "You've shown good common sense in situations like these, Janice. How do you see it?" Janice hesitated. She didn't like being put on the spot like this. "You all know what the projections are for the 6-week promotion as planned. The marketing group tells us to expect sales of 10 million dollars. Our objective is to gain first-mover advantage with this premium high-margin coffee. The fair-trade label will continue our strategy of differentiating ourselves from New Morning as the coffee shop for connoisseurs. If all goes well, we expect to gain at least two percentage points of market share, but our actual gain could be anywhere from nothing to 3, 4, maybe even 5 points. Profits during the promotion are expected to be down by 10%, but after the promotion ends, our increased market share and differentiation strategy should result in more sales, higher margins, and more profits." Tracy broke in. "That's assuming New Morning doesn't come back with their own promotion in reaction to ours. And you know what our report is from Pete. He says that he figures New Morning is up to something." "Yes, Pete did say that. But you have to remember that Pete works for our advertising agent. His incentive is to sell advertising. And if he thinks he can talk us into spending more money, he will. Furthermore, you know, he isn't always right. Last time he told us that New Morning was going to start a major campaign, he had the dates right, but it was for a different product line altogether."

Ira wouldn't let Janice off the hook. "But Janice, if New Morning does react to our promotion, would we be better off starting it early?" Janice thought for a bit. Her immediate concern was the extra pressure that an earlier-than-expected promotion would put on their supply chain. If sales of their fair trade coffees took off, then they might not have a sufficient supply to meet demand. The last thing she wanted was to disappoint consumers. Add to this the downward pressure on profits from a promotion by New Morning, and Janice was starting to realize the complexities of their situation. If she were working at New Morning and saw an unexpected promotion begin, how would she react? Would she want to cut prices to match the competition? Would she try to stick with the original plans? Finally she said, "Look, we have to believe that New Morning also has some common sense. They would not want to get involved in a price war if they could avoid it. At the same time, they aren't going to let us walk away with the market. I think that if we move early, there's about a 30% chance that they will react immediately, and we'll be in a price war before we know it." "We don't have to react to their reaction, you know," replied Ira. "You mean," asked Jack, "we have another meeting like this to decide what to do if they do react?"

"Right." "So," Janice said, "I guess our immediate options are to start our promotion early or to start it later as planned. If we start it now, we risk the possibility of not meeting consumer demand and a strong reaction from New Morning. There is only a small chance, say 10%, of demand outpacing supply. If New Morning does react, then we can decide at that point whether we want to cut our prices further." Jack spoke up, "But if New Morning reacts strongly and we don't, we would probably end up just spending our money for little financial gain. While we would further differentiate ourselves, we would gain no market share at all. We might even lose some market share. If we were to cut prices further, it would hurt profits, but at least we would be able to preserve what market share gains we had made before New Morning's initial reaction." At this point, several people began to argue among themselves. Sensing that no resolution was immediately forthcoming, Ira adjourned the meeting, asking everyone to sleep on the problem and to call him with any suggestions or insights they had.

Questions: 1. Based on the information in the case, what are Early Bird's objectives in this situation? Are there any other objectives that you think they should consider?

2. Given your answer to the previous question, what do you think Early Bird's planning horizon should be?

3. Identify the basic elements (values, decisions, uncertain events, consequences) of Early Bird's decision problem.

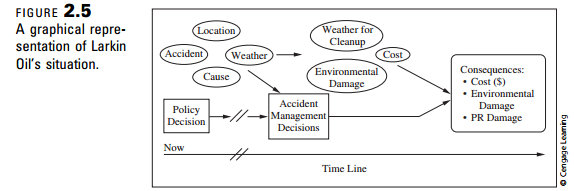

4. Construct a diagram like Figure 2.5 showing these elements.