Assignment

Write the names of all your collaborators and describe the form of collaboration.

Question 1.

a. What is the objective of an individual firm in a perfectly competitive industry?

b. Describe all the possible long-term market outcomes in a perfectly competitive industry.

c. Compare your answers in the previous parts and explain.

Question 2.

a. What are the differences and similarities (both in the firm behavior and market outcome) between a monopolistic and a monopolistically competitive industry?

b. What are these similarities and differences due to?

Question 3.

a. What are the effects of advertising in a monopolistically competitive industry?

b. How does advertising affect the cost per unit of the product in a monopolistically competitive industry?

Question 4.

|

Price (dollars per unit)

|

Quantity demanded (units)

|

|

26

|

0

|

|

24

|

1

|

|

22

|

2

|

|

20

|

3

|

|

18

|

4

|

|

16

|

5

|

|

14

|

6

|

|

12

|

7

|

|

10

|

8

|

|

Quantity produced (units)

|

Average total cost (dollars)

|

Marginal cost (dollars)

|

|

0

|

|

|

|

1

|

18.00

|

8.00

|

|

2

|

12.00

|

6.00

|

|

3

|

10.66

|

8.00

|

|

4

|

10.50

|

10.00

|

|

5

|

11.20

|

14.00

|

|

6

|

12.66

|

20.00

|

|

7

|

15.14

|

30.00

|

|

8

|

23.25

|

80.00

|

The demand and cost schedules for a firm in monopolistic competition are in the above tables. A

a. What is the profit-maximizing level of output and price?

b. What amount of profit is the firm earning?

c. Is this firm in a short-run or long-run equilibrium? Justify your answer.

Question 5.

Describe your predicted outcome in the following games:

a. Chris and Pat play the game shown below, without communicating with each other. Christ is playing the rows and Pat is playing the columns. The payoff are given as (payoff to Chris, payoff to Pat).

|

|

New York

|

San Francisco

|

|

New York

|

(3,2)

|

(1,1)

|

|

San Francisco

|

(0,0)

|

(2,3)

|

b. Chris and Pat play the game shown below, without communicating with each other. Christ is playing the rows and Pat is playing the columns. The payoff are given as (payoff to Chris, payoff to Pat).

|

|

Buy

|

Sell

|

|

Buy

|

(+1,-1)

|

(-1,+1)

|

|

Sell

|

(-1,+1)

|

(+1,-1)

|

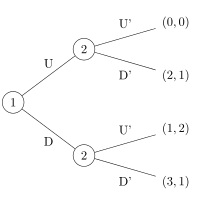

c. Players 1 and 2 play the following game.

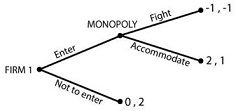

d. Firm 1 and a monopoly play the following game: