Assignment

Problem 1

An engineering production facility has developed a new device to be added to their line of products. The expenses based on the number of units produced are given in the table below.

|

Number of Units per Hour up to

|

Machinery cost per hour

|

Labor per hour

|

Power

|

Sale Price

|

|

2,000

|

$300

|

$1,400

|

$0.4/Unit

|

$2.0/Unit

|

|

4,000

|

$300

|

$1,600

|

$0.4/Unit

|

$2.0/Unit

|

Determine the following:

1. The average cost per unit for each of the 2 tiers based on the number of produced units. Each tier will be considered separately

2. The fixed cost for each of the 2 tiers

3. The variable cost for each of the 2 tiers

4. The marginal cost to move from Tier 1 to Tier 2

5. The total cost if the number of units is 3,800

6. The total revenue if the number of units is 3,800

7. The profit or loss if the number of units is 3,800

8. Draw a chart showing the fixed cost, variable cost, total cost and revenue

Problem 2

Two new rides are being compared by a local amusement park in terms of their annual operating costs. The two rides are assumed to be able to generate the same level of revenue (thus the focus on costs). The Tummy Tugger has fixed costs of $10,000 per year and a variable costs of $2.50 per visitor. The Head Buzzer has fixed costs of $4,000 per year and a variable costs of $4 per visitor. Provide answers to the following questions so the amusement park can make the needed comparison.

(a) Mathematically determine the breakeven number of visitors per year for the two rides to have equal annual costs.

(b) Develop a breakeven grap that illustrates the following:

• Accurate total cost lines for the two alternative (show line, slopes, and equations).

• The breakeven point for the two rides in terms of number of visitors.

• The ranges of visitors per year where each alternative is preferred.

Problem 3

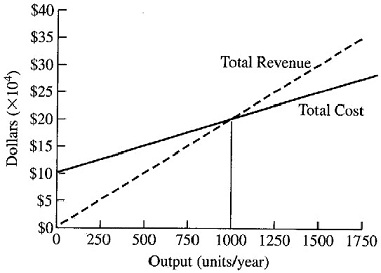

Consider the accompanying breakeven graph for an investment, and answer the following questions.

(a) Give the equation for total revenue for x units per year.

(b) Give the equation for total costs for x units per year.

(c) What is the "breakeven" level of x?

(d) If you sell 1,500 units this year, will you have a profit or loss? How much?

(e) At 1,500 units, what are your marginal and average costs?