Assignment

1. Monopolies can sometimes find themselves in difficult financial situations that lead to losses. Suppose Mr. Burns' power company has a monopoly for providing electricity in Springfield. His costs of upkeep are so high that he is consistently losing money.

a.) Show this outcome in a completely labeled graph. Clearly identify all parts of your graph, including the best price and output for the firm as well as the losses.

Now, answer the following:

b.) What happens to the market output when Mr. Burns raises the price he charges?

c.) Will this stop his losses? Why or why not?

2. Assume the following game is played one time only. Based on the information in the payoff matrix below, PNC Bank and Citizens Bank are considering an implicit collusive agreement on interest rates. Payoffs to the two firms are represented in terms of profits in thousands of dollars.

|

|

Citizens Bank

|

|

|

|

Collude: Raise Rates

|

Defect: Keep Rates Where They Are

|

|

PNC

|

Collude: Raise Rates

|

(900, 600)

|

(700, 800)

|

|

|

Defect: Keep Rates Where They Are

|

(1100, 300)

|

(800, 400)

|

a.) Does PNC have a dominant strategy? What is it?

b.) Does Citizens have a dominant strategy? What is it?

c.) Does the result of your answer change if the game is played an infinite number of times?

Why or why not? Properly use game theoretic terminology in your answer.

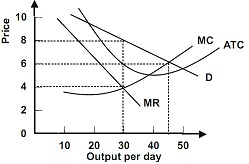

3. What is the profit-maximizing output of the monopolist shown below?

What price do they set?

What is the monopolist's markup over the competitive price?

Why will this price not fall?

4. Levi's has an advertising slogan: "Quality never goes out of style." Consumers can buy other kinds of jeans, including off-brands. The manufacturers of off-brand, or generic, jeans do not advertise. Assume that the average total cost of producing Levi's and generic jeans is the same.

a.) Create a graph showing the price (labeled as P1) that Levi's changes. Also, identify the markup.

b.) How does Levi's advertising affect their profits?

c.) Do Levi's or the generic producers have a stronger incentive to maintain quality control? Why?