Assignment - Time Series Models

Instructions: You need to write a Stata do-file to answer question 2. Your do-file must produce a log file that contains your Stata output.

1. We want to forecast the unemployment rate in the United States (UrateUS) using quarterly data from the first quarter of 1980 to the fourth quarter of 2016 (T = 36 years x 4 quarters= 144).

a) The following table presents the first four autocorrelations for the United States unemployment rate and its changes over the time period from Q1:1980 to Q4:2016. Explain briefly what the auto-correlations in the unemployment rate, Yt, measure.

Table 1: First Four Autocorrelations of the U.S. Unemployment Rate and Its Change, 1980:Q1 - 2016:Q4

|

Lag

|

Unemployment Rate Yt

|

Change in Unemployment Rate ΔYt

|

|

1

|

0.97

|

0.62

|

|

2

|

0.92

|

0.32

|

|

3

|

0.83

|

0.12

|

|

4

|

0.75

|

-0.07

|

b) The accompanying table gives the United States unemployment rate for the period 2015:Q1-2016:Q1 in levels, and the lagged unemployment rate for 2015:Q1. Fill in the blanks for the missing lagged values and the changes in the unemployment rate.

Table 2: Changes in Unemployment Rates in the U.S., Q1:2015 to Q1:2016

|

Quarter

|

Unemployment Rate Yt

|

First Lag

|

Change in Unemployment Rate ΔYt

|

|

Q1:2015

|

4.3

|

4.4

|

|

|

Q2:2015

|

4.3

|

|

|

|

Q3:2015

|

4.2

|

|

|

|

Q4:2015

|

4.1

|

|

|

|

Q1:2016

|

4.0

|

|

|

(c) You decide to test whether the unemployment rate is nonstationary. The result is as follows:

Is the unemployment rate series nonstationary? Why or why not?

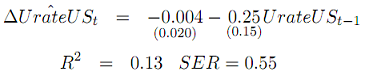

(d) You decide to estimate an AR(1) model using changes (i.e., first-differences) in the US unemployment rate. The result is as follows:

If most of the forecast error comes from uncertainty about the future error terms instead of sampling error from estimating the coefficients in the AR(1) model, then what is your best guess of the RMSFE here?

(e) The actual unemployment rate during the fourth quarter of 2015 is 4.1 percent, and it decreased from the third quarter to the fourth quarter by 0.1 percent. Using the AR(1) model's results, what is your forecast for the unemployment rate level in the first quarter of 2016?

(f) You want to see how sensitive your forecast is to changes in the specification, so you consider an AR(4) model. The results are as follows:

What is your forecast for the unemployment rate level in 2016:Q1? Compare the forecast error of the AR(4) model with the forecast error of the AR(1) model.

(g) Given the information below, which model should you use for forecasting?

|

p

|

BIC

|

AIC

|

R2

|

|

0

|

0.604

|

0.624

|

0.000

|

|

1

|

0.158

|

0.118

|

0.393

|

|

2

|

0.185

|

0.125

|

0.397

|

|

3

|

0.217

|

0.138

|

0.400

|

|

4

|

0.218

|

0.119

|

0.416

|

|

5

|

0.277

|

0.139

|

0.420

|

2. The data set macro.dta contains time series data for U.S. real aggregate personal consumption (cons), real gross domestic investment (invest), interest rates on 3 month Treasury Bills (intrate), real M1 money stock (m1), and real GDP (gdp) for 1947:Q1 -1988:Q1. cons, invest, m1 and gdp are all measured in billions of 1982 dollars.

a) Estimate autocorrelations for log(cons), log(gdp), log(m1) and intrate and their first differences. What can you say about the stationarity or non-stationarity of each series?

b) Conduct the Dickey-Fuller test for unit roots in each of the variables listed in part (a). Use 8 lags in each of the Dickey-Fuller regressions. What do you conclude for each series?

c) The Keynesian consumption function is log(cons) = β0 + β1 log(gdp) + u. Estimate this regression as specified and in first-differenced form. Interpret the effect of gdp on cons. Does your interpretation change substantively in the two versions? Which estimates are more reliable?

d) The Keynesian money demand function is log(m1) = β0 + β1 log(gdp) + β2intrate + u. Estimate this regression as specified and in first-differenced form. Interpret the effects of gdp and intrate on m1. Does your interpretation change substantively in the two versions? Which estimates are more reliable?

Attachment:- Assignment Files.rar