Additional information

|

Relevant exchange rates are: 1 July 2014

|

A$1.00 = HK$4.00

|

|

Plant, equipment and inventory acquired

|

AS1.00 = HK$4.00

|

|

Long-term bonds issued

|

AS1.00 = HK$3.50

|

|

Land acquired

|

A$1.00 = HK$3.50

|

|

|

A$1.00 = HK$3.00

|

|

Average rate for 2015 financial year

|

|

Average rate for June 2015 quader

|

A$1.00 = HK$2.25

|

|

30 June 2015

|

A$1.00 = HKS2.00

|

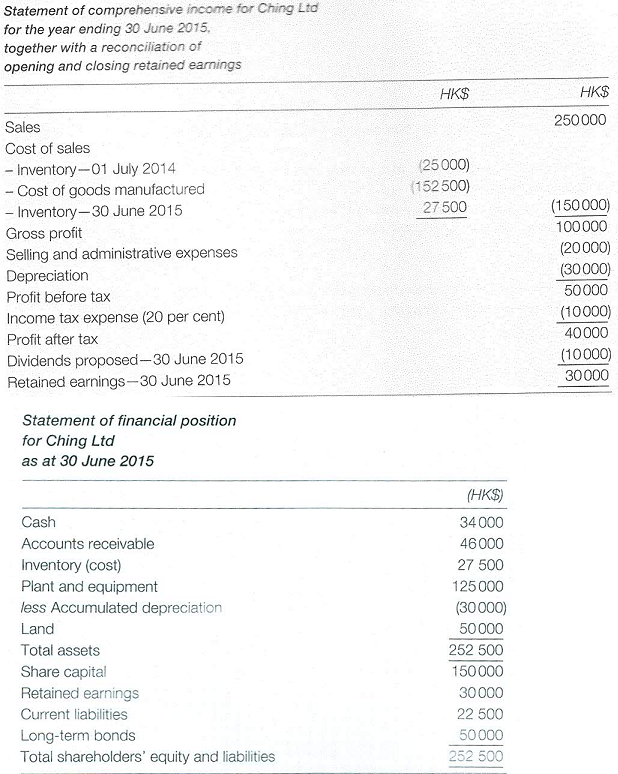

Plant, equipment and inventory are acquired on 1 July 2014. There were no monetary assets or liabilities at the commencement of business.

Long-term bonds are issued on 1 August 2014, with the principal to be repaid in full in five years. The bonds are issued in exchange land, which is to be developed as a factory site.

Inventory on hand at the end of the financial year has been manufactured throughout the June 2015 quarter.

All revenue and expense items are incurred evenly throughout the year.

REQUIRED

Translate the financial statements of Ching Ltd into Australian dollars in preparation for group consolidation in accordance with AASB 2' assuming that I-1K dollars are the function currency of Ching Ltd and the Australian dollar is the presentation currency of the group.