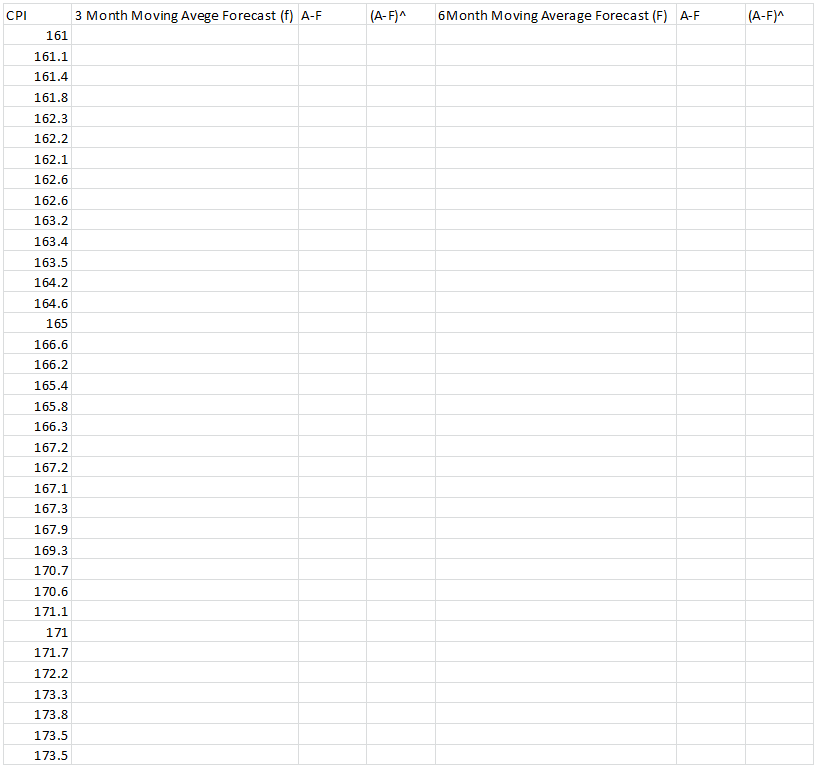

1.The following table reports the Consumer Price Index for the Los Angeles area on a monthly basis from January 1998 to December 2000 (base year = 1982-1984). Eliminating the data for 2000, use Excel to forecast the index for all of 2000 using a three month average and six month average. Which provides a better forecast for 2000 using the data provided?

2. Forecast the data for 2000 again in problem 1 with exponential smoothing with w=0.3 and w=0.7. Compare RMSEs for moving average and exponential smoothing forecasts to answer if this is a better forecast than the moving average?