1) Explain why in a perfectly competitive market the firm is a price taker. Why can't the firm choose the price at which it sells its good?

2) Leskeista produces table lamps in the perfectly competitive table lamp market.

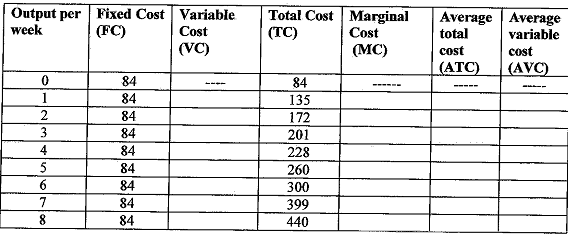

a) Fill in the missing values in the following table.

b) Suppose the market price of table lamp is $99. How many table lamps will Leskeista produce, what price will she charge, and how much profit (or loss) will she make?

c) If next week, the market price of table lamp drops to $40, bow many table lamps will Leskeista produce, what price will she charge, and how much profit (or loss) will she make?

d) Should Leskeista shut down its business in the short-run when the market price of table lamp stays $40? Explain your answer.