1. Regulators are considering controlling the emissions from two local power plants. The marginal benefits (the demands for effluent) derived by these plants from being able to produce a given quantity of effluent are 10,000-Q1 for the first plant and 10,000-2*Q2 for the second facility (where Q1 and Q2 are the quantities of effluent).

a. Graph these two individual pollution demand curves and indicate the levels of pollution (both graphically and numerically) that will be produced by these plants in the absence of regulation.

b. Find the total demand function for effluent implied by these two individual firm demand functions and add it to the graph above.

c. Suppose that the damage from the effluent is MC=1*(Q1+Q2)=Q. Add this function to the graph in part (a). What is the efficient level of effluent?

d. Regulators are considering a policy that obligates each plant to limit its emissions to half of the efficient level of total pollution you found in the previous question. Illustrate this policy on a new graph and calculate the total control (abatement) costs of this policy.

e. Acting as a consultant to regulators, you suggest that an alternative might be to impose a tax on each unit of effluent. What would the tax be if it were set at the level to achieve the efficient total amount of effluent? How much effluent would be produced by the two firms?

f. Calculate the abatement costs under the tax policy and compare their total to that achieved under the command and control policy in (d). Which policy is more cost effective? Why do you expect this finding to be true in general?

2. Two very different commercial sectors produce a common airborne pollutant located in two different geographic regions. One has marginal benefits of pollution of 1000-2e1 while the other has marginal benefits of 800-e2.

a. Write the equation for the total demand for emissions across both sectors. Does one sector have uniformly lower marginal abatement costs than the other? What is the total amount of emissions in the absence of regulation?

b. A cap and trade program is created with an initial allocation of 1000 permits. After trading occurs, what will be the market price of a unit of quota? How much will each sector emit?

c. Assuming that the initial allocation of quota was proportional to the historical shares of pollution in the previously unregulated market, who is a buyer and a seller in part b and how much quota changes hands?

d. It is later found that the marginal damage function from emissions is MD=(e1+e2)=E. How does the efficient level of emissions compare to the level achieved under the cap and trade policy above? Graphically, depict the net loss to society (the deadweight loss in econ-speak) from over/under abatement of pollution.

3. The owner of a tropical forest harvests timber so as to maximize his own profit from the land. This forested land also provides habitat for wild beehives that pollinate the crops of surrounding farmers. Assume that the number of bees and therefore the magnitude of the pollination services provided are proportional to the size of the intact forest habitat on the landowner's property. In the absence of an agreement between the landowner and his neighbors, is he likely to harvest too much or too little of his timber at any given time? Characterize this as an example of a positive or a negative externality.

4. The efficient level of a negative externality is always a positive amount (circle one: True/False). Briefly explain your answer.

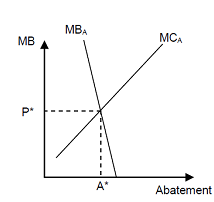

5. Examine the graph of marginal benefits and costs of abatement below. Suppose regulators expect these curves to be as shown but are uncertain as to whether or not the marginal costs of abatement curve will be higher or lower than depicted. If regulators must choose between an emissions tax or tradable quotas, which would be preferred from the perspective of efficiency, given the uncertainty in costs of abatement? Explain in a short paragraph and illustrate on this graph.