problem 1: Beta Industries manufactures floppy disks which consumers perceive as identical to such produced by numerous other manufacturers. Recently, Beta hired an econometrician to estimate its cost function for generating boxes of one dozen floppy disks. The estimated cost function is: C = 20 +2Q2

a) What are the firm’s fixed costs?

b) Determine the firm’s marginal cost?

Now assume that other firms in the market sell the product at a price of RM10.

c) How much must this firm charge for the product?

d) Determine the optimal level of output to maximize profits?

e) How much profit will be earned?

f) In long run, should this firm continue to operate or shut down? Why?

problem 2: You are the manager of a monopolistically competitive firm in short run. The inverse demand for your product is provided by P = 200 – 10Q and your marginal cost is MC = 5 + Q.

a) Find out the profit-maximizing level of output?

b) Determine the profit-maximizing price?

c) Determine the maximum profits?

d) What do you expect to happen to the demand for your product in long run if your fixed cost is lower than your answer in (d)? Describe.

problem 3: In a one-shot game, if you advertise and your rival advertises, you will each earn RM5 million in profits. If neither of you advertises, your rival will make RM4 million and you will make RM2 million. If you advertise and your rival doesn’t, you will make RM10 million and your rival will make RM3 million. If your rival advertises and you don’t, you will make RM1 million and your rival will make RM3 million.

a) prepare down the above game in matrix table.

b) Do you have a dominant strategy? What is the dominant strategy?

c) Does your rival have a dominant strategy? What is the dominant strategy?

d) Determine the Nash equilibrium for the game?

problem 4: A manager faces two separate markets. The estimated demand functions for the two markets are:

QA = 1 600 – 80PA

QB = 2 400 – 100PB

a) Find out the inverse marginal revenue functions.

b) Find the total marginal revenue functions.

c) If the manager has a total of 650 units to sell, how must the 650 units is allocated to maximize the total revenue?

problem 5: Assume the manager in problem 1 decides to price discriminate. The marginal cost is estimates to be: MC = 4.5 + 0.005Q

a) How many units must the manager produces and sells?

b) How should the manager allocate the profit-maximizing output among the two markets?

c) What prices should the manager charge in the two markets?

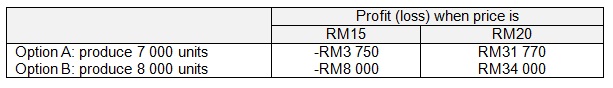

problem 6: A firm is making its production plans for next quarter; however the manager of the firm doesn’t know what the price of the product will be next month. He believes that there is a 40% probability the price will be RM15 and a 60% probability the price will be RM20. The manager should decide whether to produce 7000 units or 8000 units of output. The Given table shows the four possible profit outcomes, depending on which output management selects and which price actually takes place:

Suppose that the manager do not like risk.

a) If the manager selects the option with the higher expected profits, which output is selected? Why?

b) Which option is more risky? Why?

c) What is the decision if the manager employs the mean-variance rules to decide among the two options? Why?

d) What is the decision by using the coefficient of variation rule? Why?