You, a real-estate developer, own a piece of land in Nassau, Bahamas, next to an equal size piece of land owned by a competitor. Both of you have the choice of building a casino or a hotel. Your payoffs are as follows (competitor's payoff is listed first, yours second):

(a) What is(are) the solution(s) to this game?

(b) How much is it worth to you to get your casino building permit first?

Pricing Strategies

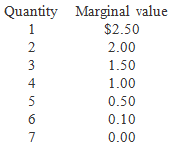

An amusement park is considering changing its pricing approach from a pay-per-ride system to a single entrance ticket entitling the ticket holder to unlimited rides. Assume that the park is not close to approaching the attendance capacity. The marginal value for rides for the typical entrant is listed below:

(a) Assuming that the marginal cost is zero to provide the rides to those in attendance, what is the best pay-per-ride price (consider only 50 cent increments)?

(b) If instead, the park wanted to charge a fixed entrance fee, what is the profit maximizing entrance fee?

(c) Under which system are profits higher? (d) Under which system is ride usage higher?

(e) If, instead, the marginal cost of providing a ride were $0.30, what revision in the pricing scheme, if any, would you suggest?

5. You are a manager of a new health spa in downtown New York. A market study estimated the average customer's monthly demand curve for visits to spa to be Qd = 50 - 0.25P. The cost of operating is C(Q) = 40Q, where Q is the number of visits (and visitors; assume everyone visits exactly once per month). The owner has been charging a $70 per-month membership fee and a $60 per-visit fee. Part of your salary is 10 percent of the monthly profits. Suggest a pricing strategy that will increase your salary.