problem 1: Foreign Exchange Market Equilibrium

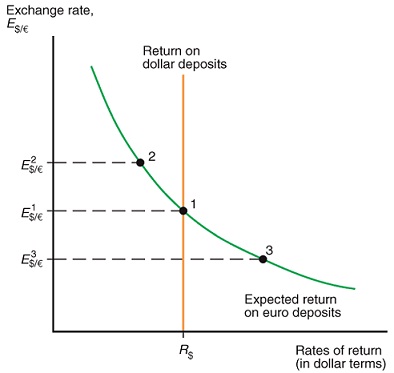

We say that the foreign exchange market is in equilibrium when deposits of all currencies o�ffer the same expected rate of return (when returns are denominated in the same currency). Formally,

a) describe why in Figure below, the foreign exchange market is not in equilibrium at points 2 and 3. Do not forget to use a graph to support your answer and describe how the equilibrium can be restored. Note that in this problem the U.S. is the domestic economy and Europe is the foreign economy.

b) Now suppose the foreign exchange market is in equilibrium (i.e. point 1 in Figure below). describe what would happen to the USD/euro nominal exchange rate if the interest rate in Europe falls. Do not forget to use a graph to support your answer.

Figure: Foreign Exchange Market Equilibrium

problem 2: The Exchange Rate and International Trade

In the past few decades, �rms from industrial economies have installed production plants in developing countries. This strategy allowed them to move production from expensive locations to cheaper ones (a phenomenon called outsourcing). If the Indian Rupee appreciates against the euro, what would happen to outsourcing in India by European companies? describe.

problem 3: Money Market and Foreign Exchange Market

a) Show how a temporary increase in a country's real money demand causes its currency to appreciate in the foreign exchange market.

b) Using a �gure describing both the U.S. money market and the foreign exchange market, analyze the e�ects of a temporary increase in the European money supply on the dollar/euro exchange rate.

problem 4: DD-AA Model

a) Suppose you are the TA of Econ 3602 and one student does not know how to derive the DD schedule. Show this student how to derive the DD schedule. Support your answer with equations and �gures.

b) One week later the same student comes to your o�ce hours and now asks you to derive the AA schedule. Show this student how to derive the AA schedule. Support your answer with equations and �gures.

c) Suppose the economy is in full employment and suddenly there is a fall in the foreign price level (P�). What would happen to output and the current account (net exports) in this economy?

problem 5: DD Schedule

describe what factors shift the DD schedule (support your answer with a graph).

problem 6: Stabilization Policies in the AA-DD Model

Suppose the economy of Zion has reached the long run equilibrium (i.e. full employment). Now assume that a best-seller, written by Neo and Trinity, entitled Buy Domestic Products convinces the public to consume less imported goods.

a) Show how the fall in the demand for imports a�ects the output of Zion in the short run.

b) Using the AA-DD model describe how the fall in the demand for imports a�ects the AA and the DD schedules, the nominal exchange rate and output (recall that we are assuming thatthe economy was at its full employment level before this shock). Support your answer with a graph.

c) Describe how �scal policy (taxes o government expenditure) can be used to restore full employment? What are the implications for the nominal exchange rate? (do not forget to include graphs to support your answer).

problem 7: Answer True or False. Briefly describe your answer. No credit without explanation. Support your answer with a graph if needed.

a) The Monetary Approach to the ER. All else equal, an increase in the interest rate in Canada is associated, in the long run, with higher prices in Canada and an appreciated exchange rate (i.e. lower e2).

b) From PPP theory we can conclude that a country with high inflation (relative to its foreign partners) should have an appreciating currency.

c) All else equal, a rise in dollar interest rates causes the dollar to appreciate against the euro while a rise in euro interest rates causes the dollar to depreciate against the euro. Today's exchange rate is also altered by changes in its expected future level. If there is a decrease in the expected future level of the dollar/euro rate, for ex, then at unchanged interest rates, today's dollar/euro exchange rate will appreciate.