Use the following information to answer questions 10 - 11

On 1/1/2010, Alma-Ata Inc. borrowed $100,000 at 12% payable annually to finance construction of a new building. In 2010, the company made the following expenditures related to the building:

3/1 $ 360,000

6/1 600,000

7/1 1,500,000

12/1 1,500,000

Additional information is provided as follows:

Other debt outstanding:

- 10-year, 13% bond, dated 12/31/2003, interest payable annually-

$4,000,000

- 6-year, 10% note, dated 12/21/2007, interest payable annually -

$1,600,000

The 3/1 expenditure included land costs of $150,000.

Interest revenue earned in 2010 = $49,000.

10. What is the amount of interest to be capitalized in 2010 in relation to the construction of the building for Alma-Alta?

a. $692,000.

b. $680,000.

c. $108,040.

d. $184,995.

e. $198,250.

f. $152,500.

g. None of the above.

11. Prepare the journal entry to record the capitalization of interest and the recognition of interest, if any, at 12/31/2010 for Alma-Ata. What amount of interest expense will be recorded?

a. $583,960.

b. $0.

c. $495,005.

d. $481,750.

e. $692,000.

f. $507,005.

g. None of the above.

12. On September 30, 2011, Bricker Enterprises purchased a machine for $200,000. The estimated service life is 10 years with a $20,000 residual value. Bricker records partial-year depreciation based on the number of months in service. Using the sum-of-the-years'-digits method, what is the amount of depreciation reported for 2012 (to the nearest dollar)?

a. $24,545.

b. $31,909.

c. $29,455.

d. $32,727.

e. $35,456.

f. $54,000.

g. None of the above.

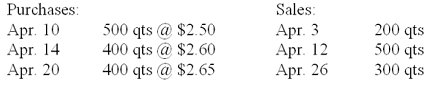

13. Texas Petrochemical reported the following April activity for its VC-30 lubricant, which had a balance of 300 qts. @ $2.40 on April 1.

What is the ending inventory assuming LIFO and a periodic inventory system?

a. $1,580.

b. $1,510.

c. $1,575.

d. $1,470.

e. $1,526.25.

f. $1,590.

g. $1,440.

h. None of the above.

14. Warren Dunn Company cans a variety of vegetable-type soups. The company adopted dollar-value LIFO on 12/31/2007. The inventory information is given below:

Date Ending Inventory Price Index

(end-of-year prices)

12/31/2007 $80,000 100

12/31/2008 $115,500 105

12/31/2009 $108,000 120

12/31/2010 $131,300 130

12/31/2011 $154,000 140

12/31/2012 $174,000 145

What is the ending inventory for Warren using dollar-value LIFO at 12/31/2010?

a. $131,300.

b. $101,000.

c. $104,800.

d. $102,500.

e. $81,000.

f. $106,300.

g. None of the above.

15. On January 1, 2011, Nana Company paid $100,000 for 8,000 shares of Papa Company common stock. These securities were classified as trading securities. The ownership in Papa Company is 10%. Papa reported net income of $52,000 for the year ended December 31, 2011. The fair value of the Papa stock on that date was $45 per share. What amount will be reported in the balance sheet of Nana Company for the investment in Papa at December 31, 2011?

a. $100,000.

b. $105,200

c. $284,400.

d. $300,000.

e. $315,600.

f. $360,000.

g. None of the above.

16. On January 2, 2010, Howdy Doody Corporation purchased 12% of Ranger Corporation's common stock for $50,000 and classified the investment as available for sale. Ranger's net income for the years ended December 31, 2010 and 2011, were $10,000 and $50,000, respectively. During 2011, Ranger declared and paid a dividend of $60,000. There were no dividends in 2010. On December 31, 2010, the fair value of the Ranger stock owned by Howdy Doody had increased to $70,000. How much should Howdy Doody show in the 2011 income statement as income from this investment?

a. $26,000.

b. $60,000.

c. $7,200.

d. $20,000.

e. $27,200.

f. $50,000.

g. None of the above.

17. On July 1, 2011, Tremen Corporation acquired 40% of the shares of Delany Company. Tremen paid $3,000,000 for the investment, and that amount is exactly equal to 40% of the fair value of identifiable net assets on Delany's balance sheet. Delany recognized net income of $1,000,000 for 2011, and paid $150,000 quarterly dividends to its shareholders. After all closing entries are made, Tremen's "Investment in Delany Company" account would have a balance of:

a. $3,200,000.

b. $3,160,000.

c. $3,400,000.

d. $3,000,000.

e. $3,080,000.

f. $4,000,000

g. None of the above.

18. White Corporation uses the FIFO method for internal reporting purposes and LIFO for external reporting purposes. The balance in the LIFO Reserve account at the end of 2010 was $80,000. The balance in the same account at the end of 2011 is $120,000. White's Cost of Goods Sold account has a balance of $600,000 from sales transactions recorded during the year. What amount should White report as Cost of Goods Sold in the 2011 income statement?

a. $480,000.

b. $560,000.

c. $600,000.

d. $640,000.

e. $720,000.

f. $680,000.

g. None of the above.

19. On September 30, 2011, Sternberg Company sold office equipment for $12,000. The equipment was purchased on March 31, 2008, for $24,000. The asset was being depreciated over a five-year life using the straight-line method, with depreciation based on months in service. No residual value was anticipated. What amount will the company record as a gain or loss on the sale of equipment?

a. Report a gain of $4,800

b. Report a gain of $1,200

c. Report a gain of $2,400

d. Report a loss of $(12,000)

e. Report a loss of $(2,400)

f. Report a gain of $3,600

g. Report a loss of $(4,800)

h. None of the above

20. Santana Company exchanged equipment used in manufacturing operations plus $2,000 in cash for similar equipment used in the operations of Delaware Company. The following information pertains to the exchange:

Santana Delaware

Equipment (cost) $28,000 $28,000

Accumulated Depreciation 19,000 10,000

Fair Value of Equipment 13,500 15,500

Cash given up 2,000 0

Prepare the journal entries to record the exchange on the books of both companies. Assume that the exchange lacks commercial substance. What amount of gain or loss will Santana and Delaware record on the exchange, respectively?

a. Santana will record a gain of $4,500, and Delaware will record a loss of $2,500.

b. Santana will record a gain of $0, and Delaware will record a loss of $0.

c. Santana will record a gain of $4,500, and Delaware will record a loss of $0.

d. Santana will record a gain of $0, and Delaware will record a loss of $2,500.

e. Santana will record a loss of $2,500, and Delaware will record a gain of $0.

f. Santana will record a loss of $2,500, and Delaware will record a gain of $6,500.

g. Santana will record a loss of $0, and Delaware will record a gain of $6,500.

h. None of the above.