Topic: International Trade Theory Questions -

Q1. A simple trade model - Consider a model with two countries, Home (H) and Foreign (F). There are two production factors, capital K and labor L.

Both countries have the same endowments: KH = KF = LH = LF = 1.

There are two goods. Consumer preferences are identical across countries and imply

c1/c2 = p1/p2 (1)

where cj denotes the consumption of good j and pj denotes the price of good j. The Home country uses the following production technologies: q1 = K1½L1½, q2 = ½K2½L2½ where qj denotes production of good j and Kj and Lj denote the amount of capital and labor, respectively, used in the production of good j. The Foreign country uses the following production technologies: q1 = ½K1½L1½, q2 = K2½L2½. Production factors are mobile across sectors but immobile across countries. Assume perfect competition. Answer the following questions:

(a) Describe each country's production possibility frontier.

(b) Solve for each country's autarky equilibrium.

(c) Which goods will the country's export under free trade? Provide a brief explanation.

(d) Solve for the free trade equilibrium (i.e. the quantities of each good produced, traded and consumed in each country as well as their relative price).

(e) Now assume that Home is capital abundant: KH = 2, LH = KF = LF = 1. Consider free trade. Discuss the new pattern of production and trade. Compared this model's predictions with those of the Ricardian and Heckscher Ohlin models.

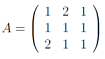

Q2. Patterns of Trade - A country's output vector is X = (2, 2, 1), the world's output vector is XW = (55, 100, 110), the price vector is p = (4, 4, 3) and the commonly used input-output coefficients are

where the first row describes labor coefficients, the second row describes land coefficients, and the third row describes capital coefficients. All countries have identical homothetic preferences and balanced trade.

(a) Describe the country's pattern of commodity trade.

(b) Describe its pattern of trade in factor content.

(c) What are the equilibrium factor prices?

Please try to answer the questions as clearly as possible showing all steps.