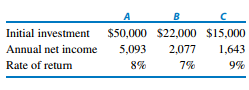

Three mutually exclusive alternatives are being considered.

Each alternative has a 20-year useful life with no salvage value. (a) Construct a choice table for interest rates from 0% to 100%. (b) If the minimum attractive rate of return is 7%, which alternative should be selected?