problem 1: In year 1975, the price level for the United States was 100, the price level for Ireland was 100 and in the foreign exchange market one Irish pound (IR£) was equivalent to $1. In 1995, the US price level had increased to 260, and the Irish level had increasing to 390.

a. According to PPP, what must the IR£-US$ exchange rate be in the year 1995?

b. If the actual dollar-pound exchange rate is $1/IR£ in 1995, is the pound overvalued or undervalued relative to the PPP?

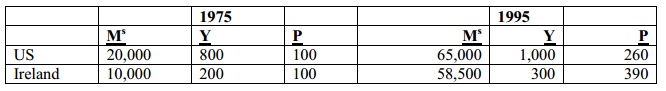

Here is additional information on the US and Irish economies

c. What is the value for v for the US in 1975? And for Ireland?

d. Using the v found in (c) for each country, does this same v hold for 1995?

problem 2: The spot exchange rate between the dollar and the British pound is floating or flexible exchange rate. What are the influences of each of the given on this exchange rate?

a. There is a big increase in British demand for US exports as US culture becomes more admired in Britain.

b. There is a big increase in British demand for investments in US$-denominated financial assets as of a British belief that the US political situation has enhanced as the Nov. 7 election.

c. Political uncertainties in Europe have lead US investors to shift their financial investments out of Britain and back into the US.

d. US demand for products imported from Britain falls considerably as bad press reports lead Americans to problems the quality of the British products.

Suppose now that the dollar-pound exchange rate is fixed (or pegged) in a narrow band around a central rate. For each (a)-(d) above, what intervention is essential by the US Federal Reserve to defend the fixed rate if the changes shift the equilibrium exchange rate to outside the exchange rate band. Label your answers (e), (f), (g), and (h), where (e) corresponds to the action the Fed would take in (a), (f) would be the action the Fed would take in (b), (g) with (c), and (h) with (d).