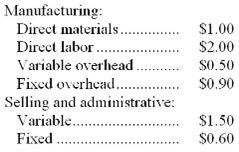

The following are the Wyeth Company's unit costs of making and selling an item at a volume of 10,000 units per month (which represents the company's capacity):

Present sales amount to 9,000 units per month. An order has been received from a customer in a foreign market for 1,000 units. The order would not affect current sales. Fixed costs, both manufacturing and selling and administrative, are constant within the relevant range between 8,000 and 10,000 units per month. The variable selling and administrative costs would have to be incurred for this special order as well as all other sales. Assume direct labor is a variable cost.

How much will the company's net operating income be increased or (decreased) if it prices the 1,000 units in the special order at $6 each?

Answer

$(500)

$400

$2,500

$1,000

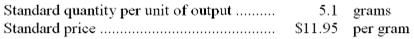

The following materials standards have been established for a particular product:

The following data pertain to operations concerning the product for the last month:

What is the materials quantity variance for the month?

Answer

$15,240 U

$6,350 U

$14,340 U

$5,975 U

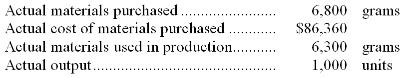

An automated turning machine is the current constraint at Greenleaf Corporation. Three products use this constrained resource. Data concerning those products appear below:

Rank the products in order of their current profitability from most profitable to least profitable. In other words, rank the products in the order in which they should be emphasized.

Answer

DK,BG,QU

DK,QU,BG

QU,BG,DK

BG,QU,DK

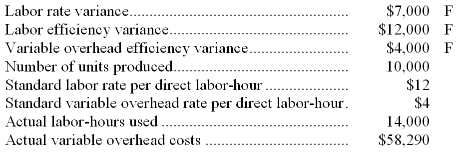

The Clark Company makes a single product and uses standard costing. Some data concerning this product for the month of May follow:

The actual direct labor rate for May in dollars per hour was closest to:

Answer

$12.50

$12.00

$11.75

$11.50

The following standards for variable overhead have been established for a company that makes only one product:

The following data pertain to operations for the last month:

What is the variable overhead rate variance for the month?

Answer

$4,194 F

$4,194 U

$2,670 F

$2,670 U

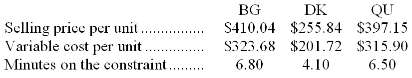

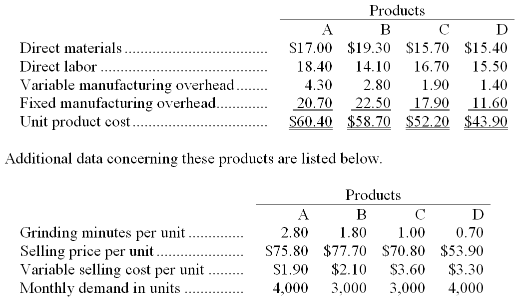

Brubacher Company makes four products in a single facility. These products have the following unit product costs:

The grinding machines are potentially the constraint in the production facility. A total of 20,500 minutes are available per month on these machines.

Direct labor is a variable cost in this company.

Up to how much should the company be willing to pay for one additional minute of grinding machine time if the company has made the best use of the existing grinding machine capacity? (Round off to the nearest whole cent.)

Answer

$0.00

$18.30

$12.21

$10.00

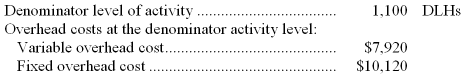

A manufacturing company uses a standard costing system in which standard machine-hours (MHs) is the measure of activity. Data from the company's flexible budget for manufacturing overhead are given below:

The following data pertain to operations for the most recent period:

What was the fixed manufacturing overhead budget variance for the period to the nearest dollar?

Answer

$1,100 F

$350 F

$2,294 U

$2,650 U

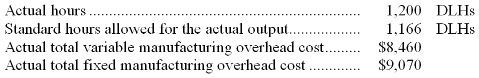

A furniture manufacturer has a standard costing system based on standard direct labor-hours (DLHs) as the measure of activity. Data from the company's flexible budget for manufacturing overhead are given below:

The following data pertain to operations for the most recent period:

What is the predetermined overhead rate to the nearest cent?

Answer

$15.94

$16.40

$14.61

$15.03

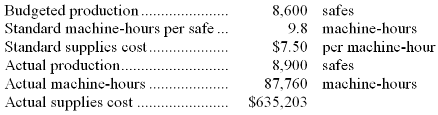

Massie Corporation, which produces commercial safes, has provided the following data:

The variable overhead efficiency variance for supplies is:

Answer

$4,050 F

$18,947 F

$18,947 U

$4,050 U

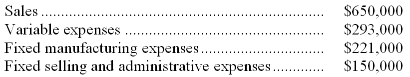

The management of Dorl Corporation has been concerned for some time with the financial performance of its product I54J and has considered discontinuing it on several occasions. Data from the company's accounting system appear below:

In the company's accounting system all fixed expenses of the company are fully allocated to products. Further investigation has revealed that $95,000 of the fixed manufacturing expenses and $85,000 of the fixed selling and administrative expenses are avoidable if product I54J is discontinued.

What would be the effect on the company's overall net operating income if product I54J were dropped?

Answer

Overall net operating income would decrease by $177,000.

Overall net operating income would increase by $177,000.

Overall net operating income would increase by $14,000.

Overall net operating income would decrease by $14,000.