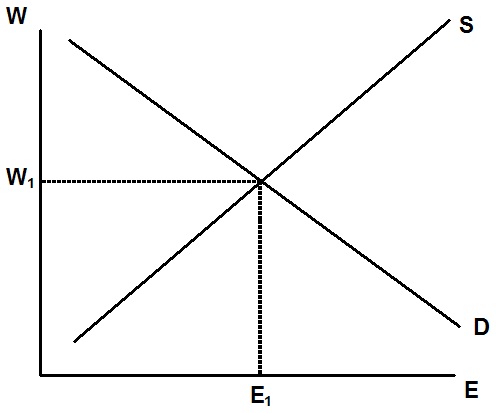

Given below is the graph of a labour market in equilibrium, with market clearing values of wages and hours of employment being W1 and E1 respectively.

problem1. The Federal government has decided to directly offer a new advantage to citizens but to fund this new program, they have decided to enforce an excise tax on employers of $t per hour of hired work. On the graph, clearly demonstrate how this tax on employers will change the market clearing values of W and E. Also, point out on your graph what the new hourly cost per worker that the firm pays.

problem2. Assume instead of the circumstances in part (a), the government mandates that the firms directly offer the new advantage. Suppose that it will still cost firms $t per hour of employment to offer the benefit. Suppose further that the workers will not value the benefit at all. On the graph, point out how this mandate fluctuates the market clearing values of W and E. After the employer mandate, what is the new hourly cost per worker that the firm pays?

problem3. Given your answers to parts (a) and (b), what is the preferred manner to offer the new benefits, through the government of though the employer mandate? Elucidate your answer.

problem4. Continuing with the situation described in part (b), assume that the mandate still costs the firms $t per hour but now, employees value the benefit at $t/hour. On the graph, point out how this mandate changes the market clearing values of W and E. After the employer mandate, what is the new hourly cost per worker that the firm pays? After the mandate, what do workers value the last hour of work?

problem5. Given your answers to (a) and (d), what is the preferred manner to deliver this benefit: through the government or through an employer mandate? Elucidate your answer.