The Department of Transportation wishes to choose between two alternative accident prevention programs. It has identified three benefits to be gained from such programs:

• Reduced property damage, both to the vehicles involved in an accident and to other property (e.g., real estate that may be damaged at the scene of an accident)

• Reduced injuries

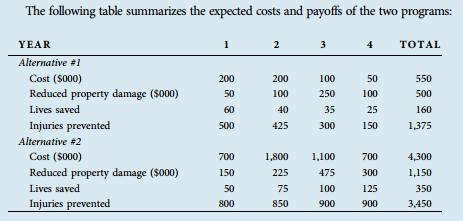

• Reduced fatalities The department's experts are willing to provide dollar estimates of property damage savings that are expected to accrue from any program, but they will only estimate the number of injuries and fatalities that may be averted. The first program is relatively moderate in its costs and will be concentrated in a large city. It involves upgrading traffic signals, improving road markers, and repaving some potholed streets. Because of the concentration and value of property in the city, savings from reduced property damage are expected to be substantial. Likewise, a moderate number of traffic-related deaths and injuries could be avoided. The second program is more ambitious. It involves straightening long sections of dangerous rural roads and installing improved guardrails. Although the property damage savings are expected to be small in relation to total cost, the reduction in traffic-related deaths and injuries should be substantial.

Assume that a 10 percent discount rate is appropriate for evaluating government programs:

a. Calculate the net present costs of the two programs.

b. Generate any other tables that you may find useful in choosing between the programs.

c. Can you arrive at any unambiguous choice between the two alternatives? What factors are likely to weigh on the ultimate choice made?