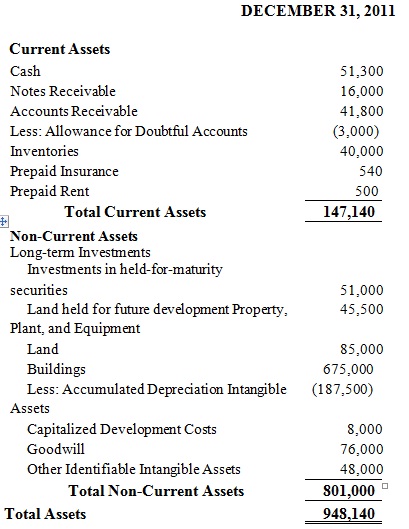

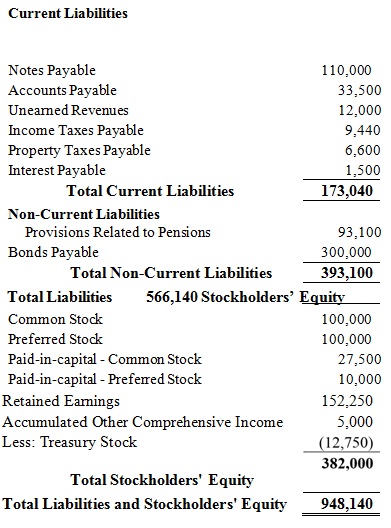

The 2011 balance sheet of Captain Jet Inc. is attached. Throughout 2012, the given events occurred.

A) On January 10, sold merchandise on account to Rayms $9,000 and Fischer $8,600. Terms 2/10, n/30, F.O.B. shipping point.

B) On January 12, purchased merchandise on account from Zapfel $3,200 and Liotta $2,600. Terms 1/10, n/30, F.O.B. destination.

C) On January 14, received checks, $4,500 from Longhini and $2,500 from Hall for sales on account after discount period has lapsed.

D) On January 15, send checks to Joosten for 9,000 less 3% cash discount and to Maida for $10,000 less 2% cash discount.

E) On January 16, issued credit of $500 to Fischer for merchandise returned.

F) On January 21, paid off the balances to Zapfel and Liotta for purchases on January 12.

G) On February 9, received payment in full from Rayms and Fischer.

H) On March 1, paid rent of $4,800 for a 2-year term beginning from May 1, 2013.

I) On April 1, the company CEO paid $49,999 from her savings bank account to purchase a car for the personal use.

J) On April 12, paid $700 cash for office supplies.

K) Cash dividends totaling $1,000 were declared on the June 13 and paid to stockholders on June 23.

L) Issued a note of $120,000 to bank (1 year, annual interest rate of 4%) for cash on July 1.

M) On July 5, purchased merchandise from Maida $32,000, terms 3/10, n/30.

N) On July 7, issued common stock 1000 shares, $10 par, in exchange of a land with the fair market value of $16,000.

O) On July 8, returned $300 of merchandise to Maida and received a credit.

P) On August 1, sold merchandise to the Lachey on account $80,000, term 1/10, n/30, F.O.B. shipping point.

Q) Paid off balance to the Maida on August 4.

R) On August 8, paid utilities expense, $10,209.

S) On August 18, Lachey paid off its balance.

T) On September 1, paid cash $7,500 to the Farmington for merchandise purchased last year.

U) On October 1, paid off notes payable $110,000 (issued in 2010) and related interest $5,000 (comprising $1,500 interest payable on the balance sheet).

V) Over the year, daily cash sales were $16,500.

W) Over the year, sales and office employees earned $46,500 in wages and salaries, of which $2,500 remained as payable at the end of year.

X) On Dec 31, received a utilities bill of $1,250 (for December 2012) and paid off the bill on January 10, 2013.

Additional Information at the end of 2012:

1) Depreciation expenditure for the year was $14,500.

2) The company estimated that it will reimburse federal income tax, $4,250.

3) Subsequent to physically counting, the company decided that the ending inventories were $41,164.

4) Based on its historical data, the bad debts are around 1% of net credit sales.

5) Unearned revenue was reduced by $11,000.

6) The company expenditures all of the supplies purchased throughout the year.

7) No insurance policy was effective throughout the year.

8) The company employs the gross technique to record its purchases and sales on credit.

9) The company adopts the periodic inventory system.

10) Rayms, Fischer and Lachey had zero balance on account as of Jan 1, 2012.

Instructions:

A) Make journal entries for each and every event.

B) Make adjusting entries.

C) Make adjusted trial balance.

D) Make Income Statement, Retained Earnings Statement and the Balance Sheet.

E) Make closing entries.

F) Please use Excel spread sheet (or similar spread-sheet software) to finish the project.

Project One: Check Figures

Please use the given check figures for the project one.

Adjusted Trial Balance: Total $1,289,061

Income Statement:

Earnings before income tax: $7,162 Retained Earnings Statement:

Retained Earnings: $154,162

Balance Sheet:

Total assets: $947,452

Total liabilities: $547,540