Task instructions:

Maplan Ltd is a manufacturer and retailer of outdoor leisure products and has produced the following draft statement of profit or loss for the year ended 30 June 2015 and draft statement of financial position at the same date.

Statement of profit or loss for the year ended 30 June 2015 (draft)

|

Revenue

|

3,973,000

|

|

Cost of sales

|

(1,560,000)

|

|

Gross profit

|

2,413,000

|

|

Administrative expenses

|

(1,975,000)

|

|

Profit before tax

|

438,000

|

|

Taxation

|

(35,700)

|

|

Profit for the year

|

402,300

|

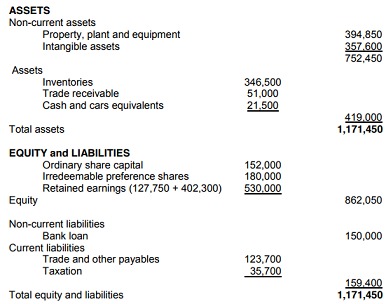

Statement of financial position as at 30 June 2015 (draft)

To assists with the finalization of the financial statements the following additional information has been prepared:

(1) The research and development expenditure relates to a new micro-fiber has been developed for the late lightweight waterproof Jackets. Of the total amount, £120,000 has been identified as research and development cost incurred before the product was considered to be commercially viable. The successful development of the material was completed during February 2015 and jackets were delivered to shops on 1 March 2015. The jackets have been popular and it is expected that it will be superseded.

(2) On July 2013 repairs costing £25,000 were carried out on some shop fittings and were recognized as an item of 'fixtures and fitting'. However, on further investigation this amount did not meet the criteria for capitalization under IAS 16 Property, Plant and Equipment.

(3) Maplan Ltd rents all of its properties under operating leases. On 1 October 2014 Maplan Ltd entered into an agreement to rent a new property. The lease is for five years. An initial three-month rent free period was given to Maplan Ltd followed by monthly payment of £2,500 on the first of each month for the remainder of the lease period. Maplan Ltd recognised the lease payments in administrative expenses as they were paid.

(4) Maplan Ltd an agreement with a number of its third party retailer whereby when a new range of clothing is launched a number of products are provided on a sale or return basis. Retailers pay for items sold on 60 days credit terms and return any unsold items at that date. Maplan Ltd makes a standard 20% mark- up on all goods sold. Maplan Ltd launched a new clothing range in May 2015. Sales of £27,000 on the sale or return basis were made and were recognized as part of revenue during Mays 2015.

(5) Depreciation for the year ended 30 June 2015 has not yet been recognized and should be charged of fixtures and fitting on a reducing balance basis at a rate of 15%pa (per annum). Depreciation should be presented in administrative expenses.

(6) During the current year, Maplan Ltd introduced an open returns policy whereby goods can be returned for a full refund within 30 days of purchase. A provision should be recognized based on 10% of sales made over the last month of reporting period. Sales in June 2015 amounted to £310,000, all of which were cash sales.

(7) Inventories included in the draft statement if financial position is the figure from the 30 June 2009 financial statements as the inventory count had not been completed in time. However, following completion of the inventory count, inventories as 30 June 2015 were valued at £375, 600.

(8) On 1 July 2014 Maplan Ltd issued 180,000 5% £1 irredeemable preference shares at par. The payment of the dividend is mandatory and if it is unpaid at the end of a period it becomes cumulative the following period. The appropriate dividend in respect of these shares was paid on 30 June 2014 and was recognized in accordance with its equity treatment made in the draft financial statements.

(9) The bank loan was taken out at the beginning of 2013 and interest is payable at 4%pa (per annum/year). Interest was paid for the year ended 30 June 2014 but remained unpaid at 30 June 2015.

Requirements:

(a) Prepare a revised statement of profit or loss for Maplan Ltd for the year ended 30 June 2010 and a revised statement of financial position as at that date in a form suitable for publication.

(b) Explain the meaning of 'present fairly' and 'true and 'fair view' and any significant differences between the two items terms.

(c) According to the IASB's (International accounting standard board) conceptual framework, all users require information regarding financial position, financial performance and change in financial positions. Explain how the information contained in the financial statements in respect of property, plant and equipment meets those information needs.