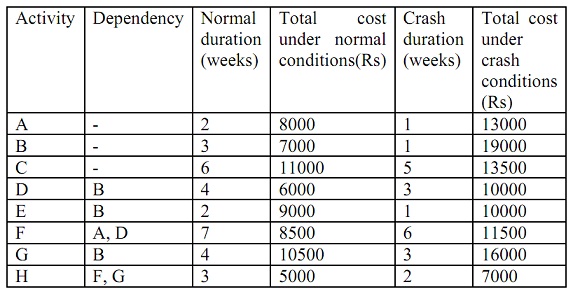

problem 1:

a) Draw the network diagram for the above project.

b) What is the normal duration for the project?

c) What is the normal cost?

d) A customer needs that the project be finished in 8 weeks and is willing to pay Rs 100,000 for that. As project manager, you are asked to give your recommendations on the feasibility (duration and profitability) of such a project. Take into consideration the fact that the company might have to pay a compensation of Rs 2000 per week, if the project is delayed beyond 8 weeks.

e) What could be the consequences of delivering projects late in the long run for a company?

problem 2: A brilliant UTM student at the end of his graduation is in presence of two opportunities and has to prefer between them. One is a job offer with a salary of Rs15,000 per month (with no other advantages except for one month end of year bonus). It is expected that the monthly salary will increase on average by 10% every year for the first 5 years of his career. His personal costs amount to Rs5,000 per month and is expected to raise by 5% every year for the next 5 years. The next opportunity is the possibility of creating his own call centre which promises the given benefits: a steady revenue stream of Rs100,000 per month with a raise of 30% every year.

Operational costs for the call centre are about Rs65,000 per month and will raise by 10% each year for the first 5 years. It is supposed that an investment of Rs500,000 will be needed in the second case that will be granted as an interest free loan by the Government with annual repayments of Rs100,000 over the next 5 years.

a) Summarize the net cash flows for each opportunity for a period of 5 years. For simplification purposes, ignore the effect of taxes (both corporate and income tax).

b) Compute the Net Present Value for each opportunity. Use 10% as discount rate.

c) Which opportunity is improved from the financial point of view?