Strategy and Game Theory Assignment

1. Uncertain Termination ABCabc

Consider the following game that is played with uncertain termination. That is, after each round the game continues with probability δ and ends with probability 1 - δ, whereupon each player gets a payoff of 0. Players move simultaneously and independently. Then each player is informed about the actions taken by the other player in the round and, given this, they play it again with probability δ. The payoff for the whole game is the expectation of the sum of the payoffs a player obtains. You may remember a version of this question from Lesson 8 where the game was played only twice. Note the payoff for (A, c) has changed.

|

|

a

|

b

|

c

|

|

A

|

3, 2

|

5, 0

|

2, 2

|

|

B

|

2, 2

|

4, 4

|

1, 2

|

|

C

|

1, 2

|

0, 2

|

2, 3

|

a) Is it possible for B and b to be played forever, in a subgame perfect equilibrium, even though (B, b) is not a Nash equilibrium in the payoff table above, if δ = 0?

b) Define a grim trigger strategy for this game.

c) Reconsider part a) if δ = 0.9.

d) What is the minimum value of δ needed to sustain cooperation?

2. Certain Termination ABCabc

Let's take the game from above and make 2 small changes...the payoff to (B, c) has changed to 1, 5 and (A, c) is 1, 1. In this case, define the total payoff equal to the sum of payoff from both rounds because both will surely be played.

|

|

Player 2

|

|

Player 1

|

|

a

|

b

|

c

|

|

A

|

3, 2

|

5, 0

|

1, 1

|

|

B

|

2, 2

|

4, 4

|

1, 5

|

|

C

|

1, 2

|

0, 2

|

2, 3

|

a) Is it possible to have B,b as part of a SPNE in the first round of a 2-round game? Why or why not?

b) Is it ever possible to have B, b as part of a SPNE in the first round of a multi-round game? Why or why not?

3. Credible Threats

Imagine a parent making a threat to a child saying "I brought you into this world, so I can take you out of it." The implication is that the parent is threatening to kill the child. The probability of a parent actually killing the child after making this threat is very low. Draw a game tree which explains why parents might make this threat and why they do not execute the threat to kill. Write a short paragraph explaining your rationale for listing the payoffs and drawing the tree the way you did.

4. Hunt for Red October

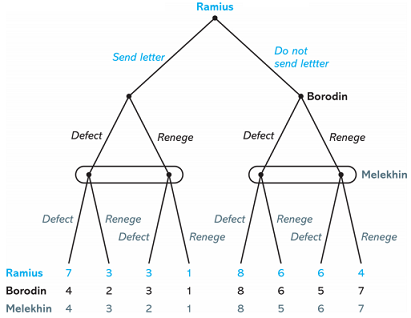

From textbook, Ch. 9, # 4: In Tom Clancy's novel Hunt for Red October, the Soviet Union has developed a submarine named Red October that can run "silently" and thereby escape detection. On its maiden voyage, the ship's captain, Marko Ramius, has decided to defect, because he believes that this technology risks war by destroying the balance of power between the United States and the USSR. He has puttogether a set of officers who are loyal to him and have agreed to defect as well. However, the captain is concerned that an officer may change his mind during the voyage and, furthermore, that an officer may be more inclined to change his mind if he thinks that other officers will do so. The captain is then considering writing a letter - to be delivered to the Soviet government after the submarine has departed from its base - stating his plan to defect. The extensive form of the game is shown below. The captain inititally decides whether or not to send the letter. After revealing his decision to his officers (once they are all out to sea), the officers, which, for tha sake of parsimony are limited to Captain Ramius, Second Rank Borodin, and Lieutenant Melekhin, simultaneously decide between continuing with the plan to defect or reneging on the plan and insisting that the submarine return to the Soviet Union. The payoffs are such that all three players would likke to defect and would prefer that it be done without the letter being sent (which results in the Soviet government sending out another submarine to sink Red October).

a) Derive all SPNE for this game.

b) Explain why the captain would send the letter.

5. Grim Trigger

There are two players engaged in a repeated prisoners' dilemma with a continuation probability of δ = 0.7. Solve for x, where x is the minimum payoff necessary to sustain cooperation in this game if both players employ a grim trigger strategy.

|

|

|

Player 2

|

|

|

|

c

|

D

|

|

Player 1

|

C

|

x, x

|

1, 5

|

|

D

|

5, 1

|

2, 2

|