Requirement #1

Using the data, which has also been provided electronically in Excel, run the following regression analyses:

• Linear regression analyzing total overhead cost and units sold

• Linear regression analyzing total overhead cost and machine hours used

• Multiple regression analysis analyzing total overhead cost along with both units sold and machine hours used

Requirement #2

Based on the results from the three regression analyses determine which correlation provides the best estimate of the total cost equation. Explain why you selected the correlation that you did.

Requirement #3

Write out the total cost equation using the results from the multiple regression test.

Requirement #4

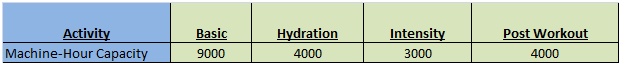

Create a "Contribution" formatted income statement using the results from the multiple regression test. Your selling price per unit and your direct material cost per unit and your direct labor cost per unit and your fringe benefits all come from the original "Traditional" income statement. Use the following additional information regarding machine hours, used by each product, to compute variable overhead.

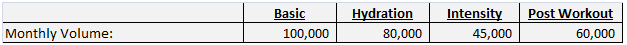

Reference the following sales volumes, by product, for your cost allocation related to units sold. This data will help you calculate variable overhead.

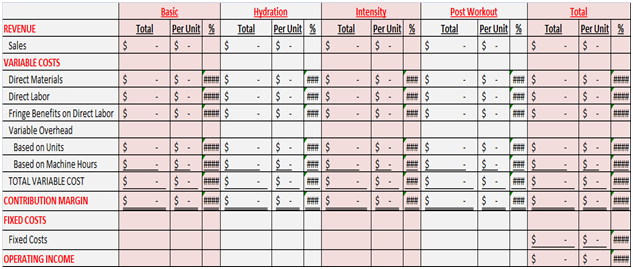

Use the following template as a guide for the format of your "Contribution" Income Statement:

Requirement #5

Compute the following:

• Break-even point in units

• Break-even point in sales dollars

• Targeted profit point in units (use $50,000 as your targeted profit point)

• Margin of Safety

Requirement #6

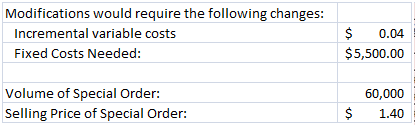

A new customer has surfaced. That customer has asked you to consider producing a special one-time order for them. This special order would require a modification to the recipe that will slightly increase the variable cost per unit. Furthermore, there would be a small fixed cost addition. The details for the order as follows:

Conduct a differential analysis regarding this special order. Would you accept this order under the conditions provided? Explain and defend your position.

Requirement #7:

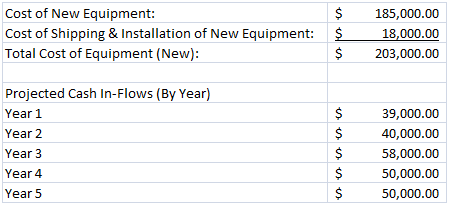

Your management team has asked you to consider investing in a new piece of equipment. The details of that investment opportunity are following:

The discount rate for this project is 5%. Compute the following:

• Net Present Value

• Internal Rate of Return

Would you recommend investing in this new piece of equipment? Explain and defend your position.

Clarification on format and data:

Clear communication and professionalism are important. Defending your answer with data is important.

• An electronic copy of this Case (this document) is available within Blackboard. Additionally, an Excel file, containing the necessary data for the case will be available within Blackboard.

• Create one professional report, in Word, that contains all of answers. In that report you should clearly label all of your answers. Make your answers easy to read and find. Imagine you were giving this report to your boss. Further imagine you have to lead your boss and the executive team through your findings. You will then have one Word document as your final product. You will also have one Excel file.

• Grading is based on both accuracy (see rubric) and your ability to communicate your answers professionally and clearly.

• Use the following naming structure for your files: last name_first initial_case3.docx. Of course your Excel file will have an .xls suffix.

• Double space your report.

• Put good thought into how you organize your Excel document. Part of your grade will be based upon the usability and layout of your Excel file. Imagine that have to give the electronic copy of your Excel file to your boss, or a peer, to work with. Imagine that you could not coach them at all on how to use your file. Is your file organized and labeled so clearly that anyone could use it, easily, without instructions from you? You want to strive for that kind of clarity in your work.

• Your report should have a title page. Use APA 6th edition for guidance on title pages.

• You will physically hand-in your report. You will also upload to Blackboard both your Word document and your Excel file.

• Late submissions will result in the following: 10% reduction in score for each 24 hour period of being late (up to 3 days). After 3 days late zero credit will be earned.

• As always please come to me with learning questions. This project is a learning experience.