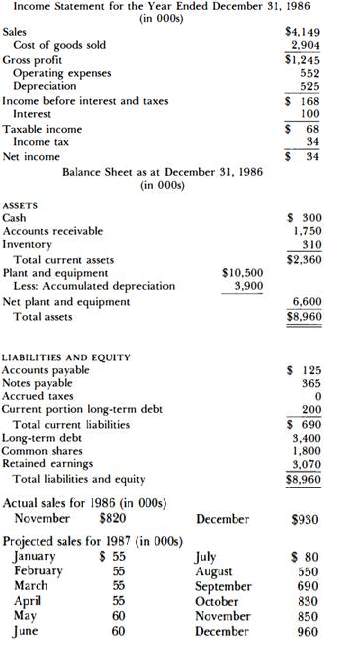

Question: You have been provided with the 1 986 financial statements of XYZ Company (reproduced below), and the following additional information (all figures are in OOOs): The demand for XYZ's products is highly seasonal, but the firm employs level production because of its limited plant capacity and the need to reduce operating costs. Costs of goods sold are 70 percent of sales, and are composed of materials purchased and wages. Estimated costs of goods sold for 1 987 are $3,010. The value of goods produced each month is 3,010/12 = $250.83. Accounts payable are paid in the month following purchase and, owing to level production, are constant at $125 per month. Wages are equal to the cost of goods sold less accounts payable, and for 1 987 are approximately 3,010 - (125 x 12) = $1,510, or $126 per month. Operating expenses are $46 per month. Depreciation is taken on a straight-line basis at $525 per year. Accounts receivable are collected after 60 days, and bad debts are negligible. Monthly cash balances must not fall below $150. A short-term loan from the bank is expected to meet any cash needs. Taxes are levied at a rate of 50 percent and are paid or refunded each December. Long-term debt repayments of $100 and interest payments of $50 are made each June and December. Annual dividends of $15 are paid at the end of December.

(a) Prepare quarterly pro Jonna financial statements for 1987.

(b) Assume that sales during the second half of 1 987 could drop 20 percent below forecasts but that neither production nor purchases could be reduced. Prepare revised pro forma statements for the final 2 quarters of 1987. Why would such information be of interest to a bank manager reviewing XYZ Company's short term loan request for 1987?