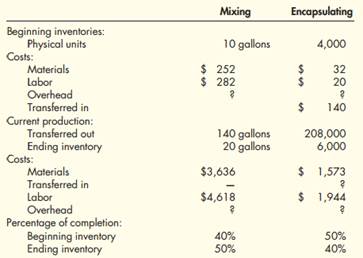

Question: Weighted Average Method, Nonuniform Inputs, Multiple Departments Benson Pharmaceuticals uses a process-costing system to compute the unit costs of the over-the counter cold remedies that it produces. It has three departments: Mixing, Encapsulating, and Bottling. In Mixing, the ingredients for the cold capsules are measured, sifted, and blended (materials are thus assumed to be uniformly added throughout the process). The mix is transferred out in gallon containers. The encapsulating department takes the powdered mix and places it in capsules (capsules are necessarily added at the beginning of the process). One gallon of powdered mix converts into 1,500 capsules. After the capsules are filled and polished, they are transferred to Bottling, where they are placed in bottles that are then affixed with a safety seal, lid, and label. Each bottle receives 50 capsules. During March, the following results are available for the first two departments:

Overhead in both departments is applied as a percentage of direct labor costs. In the mixing department, overhead is 200 percent of direct labor. In the encapsulating department, the overhead rate is 150 percent of direct labor.

Required: 1. Prepare a production report for the mixing department using the weighted average method. Follow the five steps outlined in the chapter.

2. Prepare a production report for the encapsulating department using the weighted average method. Follow the five steps outlined in the chapter.

3. Conceptual Connection: Explain why the weighted average method is easier to use than FIFO. Explain when weighted average will give about the same results as FIFO.