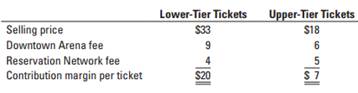

Question: Variance analysis, multiple products. The Chicago Tigers play in the American Ice Hockey League. The Tigers play in the Downtown Arena, which is owned and managed by the City of Chicago. The arena has a capacity of 15,000 seats (5,500 lower-tier seats and 9,500 upper-tier seats). The arena charges the Tigers a per-ticket charge for use of its facility. All tickets are sold by the Reservation Network, which charges the Tigers a reservation fee per ticket. The Tigers' budgeted contribution margin for each type of ticket in 2017 is computed as follows:

The budgeted and actual average attendance figures per game in the 2017 season are as follows:

Budgeted Seats Sold Actual Seats Sold

Lower tier 4,500 3,300

Upper tier 5,500 7,700

Total 10,000 11,000

There was no difference between the budgeted and actual contribution margin for lower-tier or upper-tier seats. The manager of the Tigers was delighted that actual attendance was 10% above budgeted attendance per game, especially given the depressed state of the local economy in the past six months. 1. Compute the sales-volume variance for each type of ticket and in total for the Chicago Tigers in 2017. (Calculate all variances in terms of contribution margins.)

2. Compute the sales-quantity and sales-mix variances for each type of ticket and in total in 2017.

3. Present a summary of the variances in requirements 1 and 2. Comment on the results.