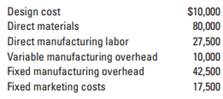

Question: Value engineering, target pricing, and locked-in costs. Sylvan Creations designs, manufactures, and sells modern wood sculptures. Sandra Johnson is an artist for the company. Johnson has spent much of the past month working on the design of an intricate abstract piece. Jim Chase, product development manager, likes the design. However, he wants to make sure that the sculpture can be priced competitively. Ellen Cooper, Sylvan's cost accountant, presents Chase with the following cost data for the expected production of 75 sculptures:

1. Chase thinks that Sylvan Creations can successfully market each piece for $3,000. To earn the required return on capital, the company's target operating income per unit is 20% of target price. Calculate the target full cost per unit of producing the 75 sculptures. Does the cost estimate Cooper developed meet Sylvan's requirements? Is value engineering needed? What is the total target operating income for the 75 sculptures?

2. Chase believes that competition will require Sylvan to reduce the price of the sculpture to $2,800. Rather than using the highest-grade wood available, Sylvan could use standard grade wood and lower the cost of direct materials by 25%. This redesign will require an additional $1,500 of design cost. Will this design change allow Sylvan to earn its total target operating income on the 75 sculptures? Is the cost of wood a locked-in cost?

3. If the price of the sculpture is $2,800, what is the total amount Sylvan can spend on direct materials for the 75 sculptures to earn the total target operating income calculated in requirement 1. What is the target cost per sculpture?

4. What challenges might managers at Sylvan Creations encounter in achieving the target cost and how might they overcome these challenges?