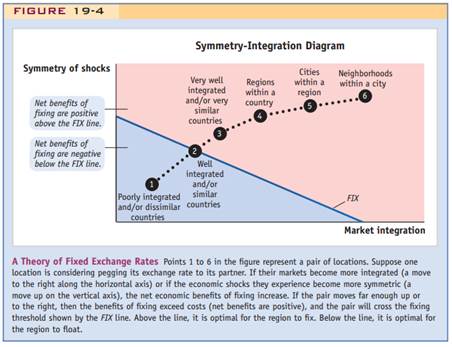

Question: Use the symmetry-integration diagram as in Figure to explore the evolution of international monetary regimes from 1870 to 1939-that is, during the rise and fall of the gold standard.

a. From 1870 to 1913, world trade flows doubled in size relative to GDP, from about 10% to 20%. Many economic historians believe this was driven by exogenous declines in transaction costs, some of which were caused by changes in transport technology. How would you depict this shift for a pair of countries in the symmetry integration diagram that started off just below the FIX line in 1870? Use the letter A to label your starting point in 1870 and use B to label the end point in 1913.

b. From 1913 to 1939, world trade flows collapsed, falling in half relative to GDP, from about 20% back to 10%. Many economic historians think this was driven by exogenous increases in transaction costs from rising transport costs and increases in tariffs and quotas. How would you depict this shift for a pair of countries in the symmetry integration diagram that started off just above the FIX line in 1913? Use the letter B to label your starting point in 1913 and use C to label the end point in 1939.

c. Other economic historians contend that these changes in transaction costs arose endogenously. When countries went on the gold standard, they lowered their transaction costs and boosted trade. When they left gold, costs increased. If this is true, then do points A, B, and C represent unique solutions to the problem of choosing an exchange rate regime?

d. Changes in other factors in the 1920s and 1930s had an impact on the sustainability of the gold standard. These included the following:

i. An increase in country-specific shocks

ii. An increase in democracy

iii. Growth of world output relative to the supply of gold

In each case, explain why these changes might have undermined commitment to the gold standard.