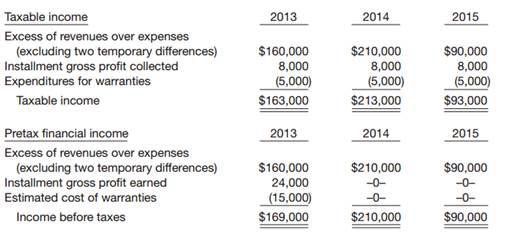

Question: (Two Temporary Differences, Tracked through 3 Years, Multiple Rates) Taxable income and pretax financial income would be identical for Huber Co. except for its treatments of gross profit on installment sales and estimated costs of warranties. The income computations shown on page 1164 have been prepared.

The tax rates in effect are 2013, 40%; 2014 and 2015, 45%. All tax rates were enacted into law on January 1, 2013. No deferred income taxes existed at the beginning of 2013. Taxable income is expected in all future years.

Instructions: Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2013, 2014, and 2015.