Question: Twilight of the UAW

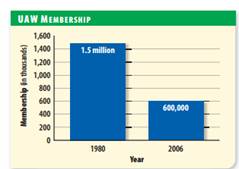

For more than two decades, the United Auto Workers (UAW) has grudgingly allowed Detroit carmakers to slash jobs as they have struggled to keep pace with the onslaught from foreign rivals. That's what UAW President Ron Gettelfinger agreed to when he signed off on General Motors Corp.'s buyout of more than 40,000 jobs at the No. 1 carmaker and its former parts unit, bankrupt Delphi Corp. Where the union has always drawn the line is on bedrock issues: wages and benefits for workers and retirees. This time, though, that line won't hold. GM's buyouts are the beginning, not the end, of the concessions the union will have to make over the next few years. What's going on is nothing less than the slow death of what was once the country's most powerful industrial union. Despite years of relentless global pressure, the UAW has been able to maintain some of the best blue-collar posts in the U.S. But like lumbering GM itself, the union failed to realize what it would take to compete in a world

economy. In the 1980s and 1990s, it fought concessions that would have helped U.S. carmakers fend off imports. Like GM and Ford, it's paying the price today. The UAW's setbacks highlight a broader challenge faced by blue-collar America. Just as union bargaining muscle helped make the middle class, so too does its weakening signal the stiffer barriers less-skilled workers face in today's globalized economy. There's another buzzsaw coming: cars from China. Every big automaker is expanding production in the Chinese market, and analysts expect most to start exporting vehicles to the U.S. in a few years.

Examining the Newsclip Question

1. Summarizing On what two issues did the UAW refuse to negotiate in the past?

2. Determining Cause and Effect How has globalization led to the decline of the UAW?