Question: This assignment is to explain core concepts related to business risk and recommend sound financial decisions based on analysis of a firm's capital structure and capital budgeting techniques.

Using complete sentences and academic vocabulary, please answer all questions in attached document. 10 questions total (Case 5 - A & B / Case 6 - A & B & C (paragraph) / Case 7 A & B). Use at least 1 citation for each Case (can be same citation if it works out)

For Case 6- C Using the mini case information, write a 250-500 word recommendation of the financial decisions you propose for this company based on an analysis of its capital structure and capital budgeting techniques.

Case 5: Integrated Waveguide Technologies, Inc. (IWT) is a 6-year-old company founded by Hunt Jackson and David Smithfield to exploit metamaterial plasmonic technology to develop and manufacture miniature microwave frequency directional transmitters and receivers for use in mobile Internet and communications applications. IWT's technology, although highly advanced, is relatively inexpensive to implement, and its patented manufacturing techniques require little capital as compared to many electronics fabrication ventures. Because of the low capital requirement, Jackson and Smithfield have been able to avoid issuing new stock and thus own all of the shares. Because of the explosion in demand for its mobile Internet applications, IWT must now access outside equity capital to fund its growth, and Jackson and Smithfield have decided to take the company public. Until now, Jackson and Smithfield have paid themselves reasonable salaries but routinely reinvested all after-tax earnings in the firm, so dividend policy has not been an issue. However, before talking with potential outside investors, they must decide on a dividend policy.

Your new boss at the consulting firm Flick and Associates, which has been retained to help IWT prepare for its public offering, has asked you to make a presentation to Jackson and Smithfield in which you review the theory of dividend policy and discuss the following issues.

A. (1) What is meant by the term "distribution policy"? How has the mix of dividend payouts and stock repurchases changed over time?

(2) The terms "irrelevance," "dividend preference," or "bird-in-the-hand," and "tax effect" have been used to describe three major theories regarding the way dividend payouts affect a firm's value. Explain these terms, and briefly describe each theory.

(3) What do the three theories indicate regarding the actions management should take with respect to dividend payouts?

(4) What results have empirical studies of the dividend theories produced? How does all this affect what we can tell managers about dividend payouts?

B. Discuss (1) the information content, or signaling, hypothesis, (2) the clientele effect, and (3) their effects on distribution policy.

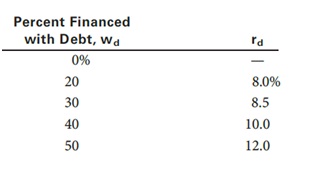

Case 6: Assume you have just been hired as a business manager of PizzaPalace, a regional pizzarestaurant chain. The company's EBIT was $50 million last year and is not expected togrow. The firm is currently financed with all equity, and it has 10 million sharesoutstanding. When you took your corporate finance course, your instructor stated thatmost firms' owners would be financially better off if the firms used some debt. Whenyou suggested this to your new boss, he encouraged you to pursue the idea. As a firststep, assume that you obtained from the firm's investment banker the followingestimated costs of debt for the firm at different capital structures:

If the company were to recapitalize, then debt would be issued and the funds received would be used to repurchase stock. Pizza Palace is in the 40% state-plus-federal corporate tax bracket, its beta is 1.0, the risk-free rate is 6%, and the market risk premium is 6%.

A. Using the free cash flow valuation model, show the only avenues by which capitalstructure can affect value.

B. (1) What is business risk? What factors influence a firm's business risk?

(2) What is operating leverage, and how does it affect a firm's business risk? Showthe operating break-even point if a company has fixed costs of $200, a sales priceof $15, and variable costs of $10.

C. Write a 250-500 word recommendation of the financial decisions you propose for this company based on an analysis of its capital structure and capital budgeting techniques

Case 7: Paul Duncan, financial manager of EduSoft Inc., is facing a dilemma. The firm wasfounded 5 years ago to provide educational software for the rapidly expanding primaryand secondary school markets. Although EduSoft has done well, the firm's founderbelieves an industry shakeout is imminent. To survive, EduSoft must grab market sharenow, and this will require a large infusion of new capital.Because he expects earnings to continue rising sharply and looks for the stock price tofollow suit, Mr. Duncan does not think it would be wise to issue new common stock atthis time. On the other hand, interest rates are currently high by historical standards, andthe firm's B rating means that interest payments on a new debt issue would be prohibitive.Thus, he has narrowed his choice of financing alternatives to (1) preferred stock, (2) bondswith warrants, or (3) convertible bonds.

A. How does preferred stock differ from both common equity and debt? Is preferredstock more risky than common stock? What is floating rate preferred stock?

B. How can knowledge of call options help a financial manager to better understandwarrants and convertibles?