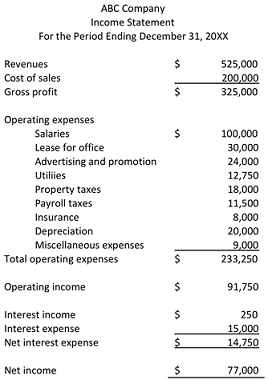

Question: THE INCOME STATEMENT

Assignment Overview: The background material for this module explains and shows examples of income statements. Pay attention to the layout and definitions of the income statement before reviewing the income statement for ABC Company shown below.

Case Assignment:

Answer the questions below and explain your answer with numbers, computations, or a sentence or two.

1. Explain the term cost of sales in your own words. Is likely that the balance sheet of this company includes inventory?

2. Gross profit (margin) is a key piece of financial information. Why is it so important?

3. Explain operating expenses? What does the term mean?

4. Does ABC Company have any employees? Explain.

5. There is an error in the income statement. Property taxes are overstated by $10,000. How is the income statement affected by a correction of property taxes?

6. What happens to net income if the company hires a new manager at a salary of $80,000?

7. Does the company own any equipment? Is it informative to also check the balance sheet to answer this question? Explain.

8. Does the company have debt? How much debt? Explain how the income statement and balance sheet provide answers to the questions?

9. How do we know that ABC Company is using the accrual basis of accounting? Hint: Do not forget to look at the balance sheet from the prior module.

10. What happens to income statement at the end of the period? Is it continuous or does it close (terminate)?

Assignment Expectations: Respond to all questions showing your computations and/or using your own words. Do not use an essay format.

Show sources when appropriate and APA format is suggested, but not required.

• The objective for this assignment is to evaluate accounting concepts of income statement.