Question: The importance of capital versus TFP: Create a new table that contains only the last three columns of the table in exercise. This time, instead of reporting the numbers relative to the U.S. value, report the inverse of these numbers. For example, you should have found that per capita GDP in Kenya relative to that in the United States was 0.030. Now express this number as the ratio of U.S. per capita GDP to Kenya's per capita GDP: 1/0.030 33. Fill in all three columns for the remaining countries.

(a) Explain in general how to interpret these numbers and in particular how the three columns are related.

(b) In the chapter, we found that about one-fourth of the differences in per capita GDP across countries were due to differences in capital per person and about three-fourths were due to differences in TFP. Carry out this calculation for Kenya. The United States is 33 times richer than Kenya; what fraction of this factor of 33 is due to differences in capital per person and what fraction is due to differences in TFP?

(c) Repeat part (b) for Ethiopia.

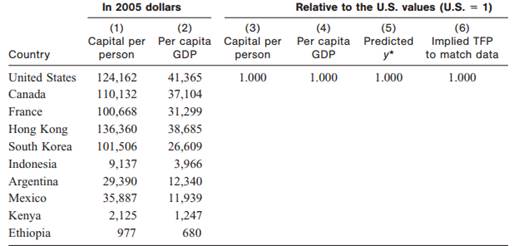

Exercise: The empirical fit of the production model: The table below reports per capita GDP and capital per person in the year 2010 for 10 countries. Your task is to fill in the missing columns of the table.

(a) Given the values in columns 1 and 2, fill in columns 3 and 4. That is, compute per capita GDP and capital per person relative to the U.S. values.

(b) In column 5, use the production model (with a capital exponent of 1/3) to compute predicted per capita GDP for each country relative to the United States, assuming there are no TFP differences.

(c) In column 6, compute the level of TFP for each country that is needed to match up the model and the data.

(d) Comment on the general results you find.