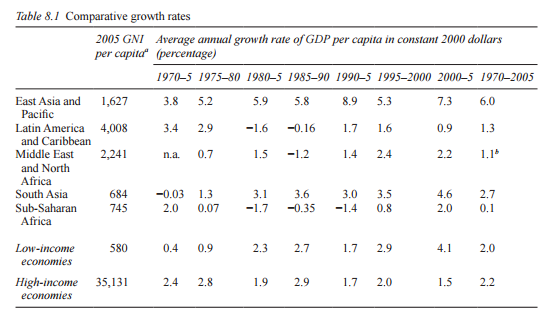

Question: Table considers income convergence by looking at aggregate income by region. Using the World Bank website (http://www.worldbank.org), find income growth figures for four different less-developed economies and for the United States, the UK, and Japan for as many years as feasible. Put the data into a table format so it is easy to compare the countries over a number of years. Has there been income convergence or divergence of the four less-developed countries you selected with the high-income economies? Discuss the evidence.