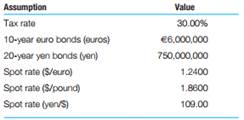

Question: Sunrise Manufacturing, Inc. Sunrise Manufacturing, Inc., a U.S. multinational company, has the following debt components in its consolidated capital section. Sunrise's finance staff estimates their cost of equity to be 20%. Current exchange rates are also listed below. Income taxes are 30% around the world after allowing for credits. Calculate Sunrise's weighted average cost of capital. Are any assumptions implicit in your calculation?