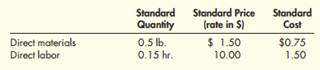

Question: Standard Costing, Planned Variances Juguette Company manufactures a plastic toy cell phone. The following standards have been established for the toy's materials and labor inputs:

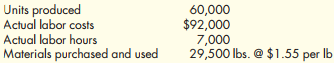

During the first week of July, the company had the following results:

Other information: The purchasing agent located a new source of slightly higher-quality plastic, and this material was used during the first week in July. Also, a new manufacturing layout was implemented on a trial basis. The new layout required a slightly higher level of skilled labor. The higher-quality material has no effect on labor utilization. Similarly, the new manufacturing approach has no effect on material usage.

Required: 1. Conceptual Connection: Compute the materials price and usage variances. Assuming that the materials variances are essentially attributable to the higher quality of materials, would you recommend that the purchasing agent continue to buy this quality, or should the usual quality be purchased? Assume that the quality of the end product is not affected significantly.

2. Conceptual Connection: Compute the labor rate and efficiency variances. Assuming that the labor variances are attributable to the new manufacturing layout, should it be continued or discontinued? Explain.

3. Conceptual Connection: Refer to Requirement 2. Suppose that the industrial engineer argued that the new layout should not be evaluated after only one week. His reasoning was that it would take at least a week for the workers to become efficient with the new approach. Suppose that the production is the same the second week and that the actual labor hours were 8,800 and the labor cost was $88,000. Should the new layout be adopted? Assume the variances are attributable to the new layout. If so, what would be the projected annual saving.