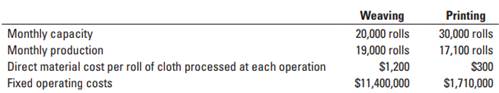

Question: Quality improvement. Dover Corporation makes printed cloth in two departments: weaving and printing. Currently, all product first moves through the weaving department and then through the printing department before it is sold to retail distributors for $2,800 per roll. Dover provides the following information:

Dover can start only 20,000 rolls of cloth in the weaving department because of capacity constraints of the weaving machines. Of the 20,000 rolls of cloth started in the weaving department, 1,000 (5%) defective rolls are scrapped at zero net disposal value. The good rolls from the weaving department (called gray cloth) are sent to the printing department. Of the 19,000 good rolls started at the printing operation, 1,900 (10%) defective rolls are scrapped at zero net disposal value. The Dover Corporation's total monthly sales of printed cloth equal the printing department's output.

1. The printing department is considering buying 10,000 additional rolls of gray cloth from an outside supplier at $2,000 per roll, which is much higher than Dover's cost of weaving the roll. The printing department expects that 10% of the rolls obtained from the outside supplier will result in defective products. Should the printing department buy the gray cloth from the outside supplier? Show your calculations.

2. Dover's engineers have developed a method that would lower the printing department's rate of defective products to 6% at the printing operation. Implementing the new method would cost $1,400,000 per month. Should Dover implement the change? Show your calculations.

3. The design engineering team has proposed a modification that would lower the weaving department's rate of defective products to 3%. The modification would cost the company $700,000 per month. Should Dover implement the change? Show your calculations.