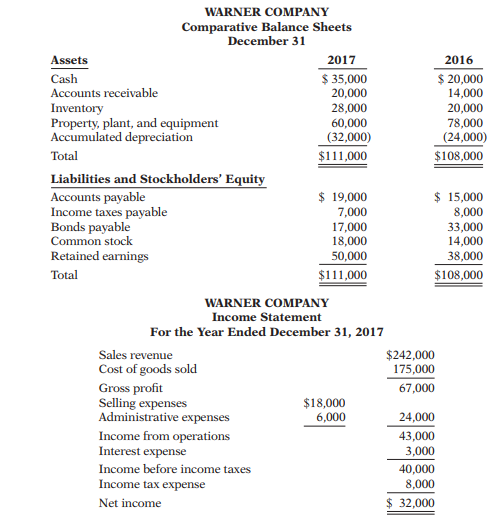

Question: Presented below are the financial statements of Warner Company

Additional data: 1. Depreciation expense was $17,500.

2. Dividends declared and paid were $20,000.

3. During the year equipment was sold for $8,500 cash. This equipment cost $18,000 originally and had accumulated depreciation of $9,500 at the time of sale.

Instructions: (a) Prepare a statement of cash flows using the indirect method.

(b) Compute free cash flow.