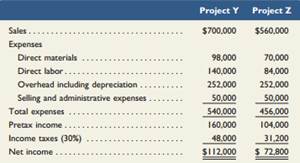

Question: Pleasant Company has an opportunity to invest in one of two new projects. Project Y requires a $700,000 investment for new machinery with a four-year life and no salvage value. Project Z requires a $700,000 investment for new machinery with a three-year life and no salvage value. The two projects yield the following predicted annual results. The company uses straight-line depreciation, and cash flows occur evenly throughout each year.

Required: 1. Compute each project's annual expected net cash flows. (Round the net cash flows to the nearest dollar.)

2. Determine each project's payback period. (Round the payback period to two decimals.)

3. Compute each project's accounting rate of return. (Round the percentage return to one decimal.)

4. Determine each project's net present value using 8% as the discount rate. For part 4 only, assume that cash flows occur at each year-end. (Round the net present value to the nearest dollar.)

Analysis Component

5. Identify the project you would recommend to management and explain your choice.