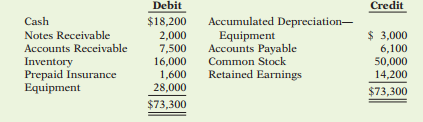

Question: On December 1, 2017, Ravenwood Company had the following account balances.

During December, the company completed the following transactions.

Dec. 7 Received $3,600 cash from customers in payment of account (no discount allowed).

12 Purchased merchandise on account from Greene Co. $12,000, terms 1/10, n/30.

17 Sold merchandise on account $16,000, terms 2/10, n/30. The cost of the merchandise sold was $10,000.

19 Paid salaries $2,200. 22 Paid Greene Co. in full, less discount.

26 Received collections in full, less discounts, from customers billed on December 17.

31 Received $2,700 cash from customers in payment of account (no discount allowed).

Adjustment data: 1. Depreciation $200 per month.

2. Insurance expired $400.

3. Income tax expense was $425. It was unpaid at December 31.

Instructions: (a) Journalize the December transactions. (Assume a perpetual inventory system.)

(b) Enter the December 1 balances in the ledger T-accounts and post the December transactions. Use Cost of Goods Sold, Depreciation Expense, Insurance Expense, Salaries and Wages Expense, Sales Revenue, Sales Discounts, Income Taxes Payable, and Income Tax Expense.

(c) The statement from Lyon County Bank on December 31 showed a balance of $25,930. A comparison of the bank statement with the Cash account revealed the following facts.

1. The bank collected the $2,000 note receivable for Ravenwood Company on December 15 through electronic funds transfer.

2. The December 31 receipts were deposited in a night deposit vault on December 31. These deposits were recorded by the bank in January.

3. Checks outstanding on December 31 totaled $1,210.

4. On December 31, the bank statement showed a NSF charge of $680 for a check received by the company from M. Lawrence, a customer, on account. Prepare a bank reconciliation as of December 31 based on the available information. (Hint: The cash balance per books is $26,100. This can be proven by finding the balance in the Cash account from parts (a) and (b).)

(d) Journalize the adjusting entries resulting from the bank reconciliation and adjustment data.

(e) Post the adjusting entries to the ledger T-accounts.

(f) Prepare an adjusted trial balance.

(g) Prepare an income statement for December and a classified balance sheet at December 31.