Question: (Major Pension Concepts) Davis Corporation is a medium-sized manufacturer of paperboard containers and boxes. The corporation sponsors a noncontributory, defined benefit pension plan that covers its 250 employees. Sid Cole has recently been hired as president of Davis Corporation. While reviewing last year's financial statements with Carol Dilbeck, controller, Cole expressed confusion about several of the items in the footnote to the financial statements relating to the pension plan. In part, the footnote reads as follows. Note J. The company has a defined benefit pension plan covering substantially all of its employees.

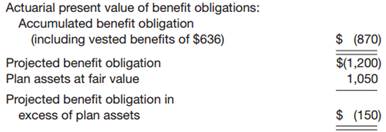

The benefits are based on years of service and the employee's compensation during the last four years of employment. The company's funding policy is to contribute annually the maximum amount allowed under the federal tax code. Contributions are intended to provide for benefits expected to be earned in the future as well as those earned to date. The net periodic pension expense on Davis Corporation's comparative income statement was $72,000 in 2014 and $57,680 in 2013. The following are selected figures from the plan's funded status and amounts recognized in the Davis Corporation's Statement of Financial Position at December 31, 2014 ($000 omitted).

Given that Davis Corporation's work force has been stable for the last 6 years, Cole could not understand the increase in the net periodic pension expense. Dilbeck explained that the net periodic pension expense consists of several elements, some of which may increase or decrease the net expense. Instructions

(a) The determination of the net periodic pension expense is a function of five elements. List and briefly describe each of the elements.

(b) Describe the major difference and the major similarity between the accumulated benefit obligation and the projected benefit obligation.

(c) (1) Explain why pension gains and losses are not recognized on the income statement in the period in which they arise.

(2) Briefly describe how pension gains and losses are recognized.