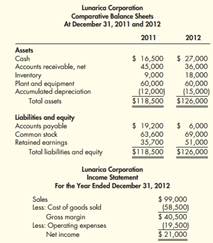

Question: Lunarica Corporation has the following comparative financial statements:

Dividends of $5,700 were paid. No equipment was purchased or retired during the current year. Statement of Cash Flows, Indirect Method Refer to the information for Lunarica Corporation above.

Required: Prepare a statement of cash flows using the indirect method.