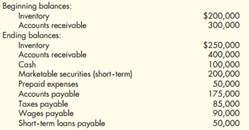

Question: Liquidity Analysis The following selected information is taken from the financial statements of Arnn Company for its most recent year of operations:

During the year, Arnn had net sales of $2.45 million. The cost of goods sold was $1.3 million.

Required: 1. Compute the current ratio.

2. Compute the quick or acid-test ratio.

3. Compute the accounts receivable turnover ratio.

4. Compute the accounts receivable turnover in days.

5. Compute the inventory turnover ratio.

6. Compute the inventory turnover in days.