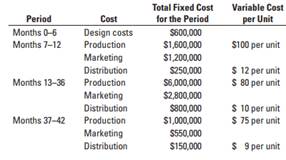

Question: Life-cycle budgeting and costing. Arnold Manufacturing, Inc., plans to develop a new industrialpowered vacuum cleaner for household use that runs exclusively on rechargeable batteries. The product will take 6 months to design and test. The company expects the vacuum sweeper to sell 12,000 units during the first 6 months of sales; 24,000 units per year over the following 2 years; and 10,000 units over the final 6 months of the product's life cycle. The company expects the following costs:

Ignore the time value of money.

1. If Arnold prices the sweepers at $400 each, how much operating income will the company make over the product's life cycle? What is the operating income per unit?

2. Excluding the initial product design costs, what is the operating income in each of the three sales phases of the product's life cycle, assuming the price stays at $400?

3. How would you explain the change in budgeted operating income over the product's life cycle? What other factors does the company need to consider before developing the new vacuum sweeper?

4. Arnold is concerned about the operating income it will report in the first sales phase. It is considering pricing the vacuum sweeper at $450 for the first 6 months and decreasing the price to $400 thereafter. With this pricing strategy, Arnold expects to sell 10,000 units instead of 12,000 units in the first 6 months, and the same number of units for the remaining life cycle. Assuming the same cost structure given in the problem, which pricing strategy would you recommend? Explain.