Question: Kicker Speakers, Before-The-Fact Flexible Budgeting, Flexible Budgeting for the New Solo X18 Model Stillwater Designs is considering a new Kicker speaker model: Solo X18, which is a large and expensive subwoofer (projected price is $760 to distributors). The company controls the design specifications of the model and contracts with manufacturers in mainland China to produce the model. Stillwater Designs pays the freight and custom duties. The product is shipped to Stillwater and then sold to distributors throughout the United States. The market for this type of subwoofer is small and competitive. It is expected to have a 3- year life cycle.

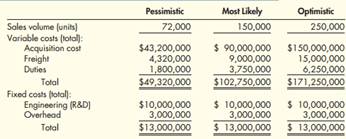

Market test reviews were encouraging. One potential customer noted that the speaker could make a deaf person hear again. Another remarked that the bass could be heard two miles away. Another customer was simply impressed by the size and watts of the subwoofer (a maximum of 10,000 watts capability). Encouraged by the results of market tests, the Product Steering Committee also wanted to review the financial analysis. The projected revenues and costs at three levels of sales volume are as follows (for the 3-year life cycle):

Required: 1. Prepare flexible budget formulas for the cost items listed for the Solo X18 model. Also, provide a flexible budget formula for total costs.

2. Conceptual Connection: Prepare an income statement for each of the three levels of sales volume. Discuss the value of before-the-fact flexible budgeting and relate this to the current example.

3. Conceptual Connection: Form a group with two to four other students. Assume that the group is acting as a Product Steering Committee. Evaluate the feasibility of producing the Solo X18 model (using the given financial data and the results of Requirements 1 and 2.) If the financial performance of the model is questionable, discuss possible courses of action that the company might take to improve the financial performance of the product. Also, discuss some reasons why the company might wish to produce the model even if it does not promise a good financial return.