Question: (Journal entries, statement of activities, statement of functional expenses for an NFPO) Sing Sing Singers (SSS) is a local opera company. It finances its activities through contributions and admissions fees. It accounts for its expenses though four major functions: regular events, special events, administration, and fund-raising. For each function, it maintains three object accounts: salaries, supplies and other, and occupancy. On July 1, 2012, the start of its fiscal year, SSS had cash on hand amounting to $12,000, of which $7,000 represented unrestricted net assets and $5,000 represented temporarily restricted net assets. The following transactions and events occurred during the year. Prepare journal entries to record these transactions; also, prepare a statement of activities and a statement of functional expenses for the year ended June 30, 2013.

1. The $5,000 of temporarily restricted net assets resulted from a donation made during the previous year that could be used only during the year beginning July 1, 2012.

2. SSS held its annual fund-raising dinner at a cost of $3,000 (use object account supplies and other). As a result of the dinner, SSS received cash contributions of $10,000 and pledges totaling $40,000. Based on prior experience, SSS estimated it would collect 90 percent of the pledges in cash.

3. SSS collected $37,000 in cash on the pledges received in transaction 2 and wrote off the other pledges as uncollectible.

4. SSS trustees received the following cash donations:

a. $15,000 from T. Robbins, to be used solely for the purpose of a special presentation of The Marriage of Figaro at the Shawshank Correctional Center in Ossining.

b. $25,000 from the Chester County Council on the Arts, to be used for any purpose deemed appropriate by the trustees.

5. SSS performed The Marriage of Figaro at Shawshank, spending the entire $15,000 donation on salaries for the performers. Expenses were charged to Special events.

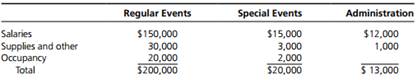

6. SSS collected $162,000 in admissions fees from its opera performances during the year. It also had the following expenses, which it paid in cash:

7. SSS received the benefit of the following donated services during the year:

a. M. Freeman, a lawyer, prepared contracts with the performers. Had Freeman charged for this work, the cost to SSS would have been $4,000.

b. W. A. Mozart, a carpenter, constructed sets for the regular events. Had Mozart charged for this work, the cost to SSS would have been $8,000.

c. Local bankers G. Donizetti and G. Puccini served as ushers for all performances. Had SSS paid for this work, the cost would have been $1,000.