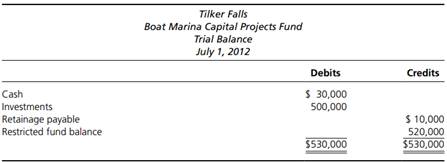

Question: (Journal entries for several funds and financial statements for a Capital Projects Fund) Following is a trial balance for the Tilker Falls Boat Marina Capital Projects Fund and the transactions that relate to the 2012-2013 fiscal year. Prepare all the journal entries necessary to record these transactions and close the Capital Projects Fund. In addition, identify the fund(s) used (a Vouchers payable account is not used). Also, prepare a statement of revenues, expenditures, and changes in fund balance for the Boat Marina Capital Projects Fund for the 2012-2013 fiscal year.

1. The budget for the marina project provided for a remaining appropriation of $500,000. Record the budget, and reestablish the budgetary accounts for encumbrances, which totaled $500,000 on June 30, 2012. Assume $30,000 of investment income (dividends and interest) is budgeted.

2. The contractor, Martinez Construction, submitted a progress billing on the marina for $300,000. The billing, less retainage of 10 percent, was approved.

3. Investments were redeemed for $320,000. This amount included $20,000 of investment income.

4. Martinez Construction was paid the amount billed in transaction 2, less the 10 percent retainage.

5. Investment income of $15,000 was received in cash.

6. The final billing was received from Martinez Construction for $200,000. The billing, less the retainage of 10 percent, was approved.

7. All remaining investments were redeemed for $205,000. This amount included $5,000 of investment income.

8. Martinez Construction was paid the amount billed in transaction 6, less a 10 percent retainage.

9. During final inspection of the project, prior to official acceptance, several construction defects were noted by the city engineer. Because Martinez Construction had already relocated its workers and equipment, the city was authorized to have the repairs made by a local contractor at a cost not to exceed $40,000. The actual cost of the repairs totaled $32,000. The remainder of the retainage was sent to Martinez Construction.

10. After the repairs, the project was formally approved, and the accounting records were closed. The remaining cash was transferred to the Debt Service Fund.