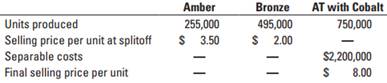

Question: Joint-cost allocation, process further or sell. Arnold Technologies manufactures a variety of flash memory chips at its main plant in Taiwan. Some chips are sold to makers of electronic equipment while others are embedded into consumer products for sale under Arnold's house label, AT. Three of the chips that Arnold produces arise from a common production process. The first chip, Amber, is sold to a maker of smartphones and personal computers. The second chip, Bronze, is intended for a wireless and broadband communication firm. The third chip, Cobalt, is used to manufacture and market a solid-state device under the AT name. Data regarding these three products for the fiscal year ended April 30, 2017, are given below.

Arnold incurred joint product costs up to the splitoff point of $5,400,000 during the fiscal year. The head of Arnold, Amanda Peterson, is considering a variety of alternatives that would potentially change the way the three products are processed and sold. Proposed changes for each product are as follows:

- Amber chips can be incorporated into Arnold's own memory stick. However, this additional processing causes a loss of 27,500 units of Amber. The separable costs to further process Amber chips are estimated to be $750,000 annually. The memory stick would sell for $5.50 per unit.

- Arnold's R&D unit has recommended that the company process Bronze further into a 3D vertical chip and sell it to a high-end vendor of datacenter products. The additional processing would cost $1,000,000 annually and would result in 15% more units of product. The 3D vertical chip sells for $4.00 per unit.

- The third chip is currently incorporated into a solid-state device under the AT name. Galaxy Electronics has approached Arnold with an offer to purchase this chip at the splitoff point for $2.40 per unit.

1. Allocate the $5,400,000 joint production cost to Amber, Bronze, and AT with Cobalt using the NRV method.

2. Identify which of the three joint products Arnold should sell at the splitoff point in the future and which of the three the company should process further to maximize operating income. Support your decisions with appropriate computations.