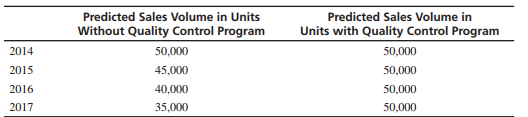

Question: Investment in Quality The Sydney Manufacturing Company produces a single model of a high-quality DVD player that it sells to Australian manufacturers of sound systems. It sells each DVD player for $210, resulting in a contribution margin of $70 before considering any costs of inspection, correction of product defects, or refunds to customers. On January 1, 2014, top management at Sydney is contemplating a change in its quality control system. Currently, the company spends $30,000 annually on quality control inspections for the 50,000 DVD players it produces and ships each year. In producing those DVD players, the company produces an average of 2,000 defective units. The inspection process identifies 1,500 of these, and the company spends an average of $85 on each to correct the defects. The company ships the other 500 defective players to customers. When a customer discovers a defective DVD player, Sydney Manufacturing refunds the $210 purchase price. Many of Sydney's customers build the DVD players into home-entertainment units. As more of these customers change to JIT inventory systems and automated production processes, the receipt of defective goods poses greater and greater problems for them. Sometimes a defective DVD player causes them to delay their whole production line while they replace the DVD player. Companies competing with Sydney recognize this situation, and most have already begun extensive quality control programs. If Sydney does not improve quality, sales volume is expected to fall by 5,000 DVD players a year, beginning after 2014:

The proposed quality control program has two elements. First, Sydney would spend $950,000 immediately to train workers to recognize and correct defects at the time they occur. This is expected to cut the number of defective DVD players produced from 2,000 to 500 without incurring additional manufacturing costs. Second, an earlier inspection point would replace the current inspection. This would require purchase of an X-ray machine at a cost of $250,000 plus additional annual operating costs of $60,000 more than the current inspection costs. Early detection of defects would reduce the average amount spent to correct defects from $85 to $50, and only 50 defective DVD players would be shipped to customers. To compete, Sydney would refund one-and-one-half times the purchase price ($315) for defective DVD players delivered to customers. Top management at Sydney has decided that a 4-year planning period is sufficient for analyzing this decision. The required rate of return is 20%. For simplicity, assume that under the current quality control system, if the volume of production decreases, the number of defective DVD players produced remains at 2,000. Also assume that all annual cash flows occur at the end of the relevant year. Should Sydney undertake the new quality control program? Explain using the NPV model. Ignore income taxes.